Exchange Traded Frenzy: Part One

The rise of active ETFs and when Unusual Whales went Subversive

This is the first of a multi-part series focused on the rise of a certain brand of exchange-traded funds (ETF), with special attention paid to gimmicky products and shameless businesses that I believe contribute to the systematic bastardization of investing.

The idea of an ETF was conceived about thirty years ago. Canada led the way with the first iteration in 1990, which was followed three years later by the launch of the SPDR S&P 500 ETF Trust (SPY), now the world’s largest ETF.

These new vehicles were originally designed to help institutions execute sophisticated trading strategies. But they quickly evolved to offer investors of all stripes an efficient way to gain passive market exposure.

Simply put, passive investing eschews any attempt to add value via security selection and instead seeks to replicate exposure to a given index. The thinking here is that active investment approaches generally fail to beat the market on a net basis, leaving investors better served by simply settling for the market itself.

Passive investing gained popularity thanks to folks like John Bogle, Eugene Fama, and Burton Malkiel, thinkers whose collective work demonstrated the wisdom of cheap, broad market exposure. Their findings persist to this day, with the average active fund manager tending to underperform its benchmark over most time periods.

In those early days, passive implementation was largely achieved via mutual funds, which could be expensive, illiquid, and unwieldy. ETFs were thusly meant to offer an inexpensive, transparent, and liquid alternative.

So instead of paying expensive fees for an active mutual fund manager to underperform the market (however defined), it began to make more sense for investors to seek out (mostly passive) ETFs for their equity and fixed income exposures.

The popularity of ETFs surged as a result, growing from just a handful of listings 30 years ago to over 11,000 today, with total assets now approaching $11 trillion.

While they didn’t technically birth the passive revolution, ETFs did facilitate it, also paving the way for a factor explosion that allowed investors to solve for a plethora of bespoke exposures.

For example, investors can now target their allocations to small-cap stocks rather than settling for broad equity market exposures. They can drill down even further to small-cap value if they’d like. And if they’re feeling especially frisky, there are several ETFs for those seeking dedicated exposure to Japanese small-cap value stocks.

This feels overwrought to some of us, a paradox of choice that does more stunting than stimulating. I suppose all those registered investment advisors need to earn their paychecks somehow, and the Wall Street fee factory is happy to oblige. Complexity theater is part of the game, after all, so asset allocation decisions ostensibly require forced difficulty adjustments. But color me skeptical that the average consumer is made better by all the kabuki.

And things have sadly gotten worse.

The retail trading revolution that gained steam in the COVID years has created a lot of bad habits, some of which have led to the proliferation of gimmicky products like active ETFs. Instead of pursuing (mostly) passive approaches to providing market exposure, these new ETFs are actively managed to either pursue legacy investment strategies or solve for…other stuff.

Indeed, a subset of this universe is designed to appeal to a retail audience easily amused by shiny new things. Propelled by zero-commission online trading and the general gamification of investing, many of these funds tap into a trading frenzy that prioritizes fads over fundamentals. And it appears we’re all here for it since active ETFs are among the fastest-growing investment products around.

Some of the growth we’ve witnessed among these funds has surely been the result of a secular shift away from the mutual fund structure. And plenty of proper strategies are being employed by some of these products.

For example, for all the grief I’ve given personalities like George Noble and Michael Gayed, at least they implement(ed) strategies with some semblance of legitimacy. Sure, Noble’s NOPE ETF suffered from atrocious portfolio construction, and the ATAC fund family is statically based on naive academic research, but their aims are (were) at least somewhat pure in an investment sense.

In contrast, many active ETFs are built upon the flimsiest of existential foundations. It’s hard to justify any responsible need for funds focused on KPOP or memes or politics, but this new era of “investing” is happy to serve up such nonsense.

I believe the existence of these vehicles represents a moral blight on the investment industry. They do a massive disservice to the profession and consumers alike, manufacturing superficial demand for products that cater to impulse and capitalize on misunderstanding.

But we are a product of our age, which makes the traction gained by this type of investing understandable. These new gizmos channel the same energy that brings popularity to disinformation peddlers on social media, schemes rewarded for openly trolling their followers. Quoting the great Larry David, they spew a “jetstream of bullshit” that appeals to our basest instincts. These are low-IQ products made for a universe of C+ investors. And I’m here to combat certain of their purveyors.

Behold, then, the future of finance…in all its bastardized glory.

Unusual Whales / Subversive ETFs

Unusual Whales (UW) is a popular character on FinX (formerly known as FinTwit or Financial Twitter). The account can usually be found regurgitating news headlines to its 1.5 million followers, with a strong emphasis on the cowbell variety. This sort of approach is a common marketing tactic for Finfluencers: Offer low-value news curation - often draped in doomerism - to attract eyeballs to whatever product they’re pushing.

Anytime you’re looking to have your good spirits dampened, just take a peek at UW’s feed and you’ll surely find reasons to be anxious about something. Here’s a sampling of some recent posts to provide a taste of the account’s vibe.

UW is a good case study for this type of engagement farming since its primary business is an options data and trading service geared towards retail investors. I don’t need to know anything about the quality of this offering to know that it sucks. This hot take gets to the heart of an admitted bias of mine, which stems from a belief that those most likely to profit from these services are their creators rather than users.

In much the same way professional fund managers tend to underperform their benchmarks, it’s well-established that most retail traders lose money. This is especially true for those who trade options, which makes sense given their relative complexity - and which makes UW all the more nefarious.

You see, I’m of the mind that anyone offering retail trading, research, or data services through social media is complicit in the general fleecing of amateur investors. They seek to enrich themselves through offerings that encourage probabilistically unprofitable behavior. They are grifters, even if their perniciousness is unintentional.

There is no reason to believe that your anonymous trading furu: 1) Is actually skilled at investing; or 2) Would be willing to share their secrets with you even if they were.

There is no reason to believe that paying for a no-pedigree rando to pontificate about macro or earnings will be accretive to anyone’s process.

There is no reason to believe that access to more data is what is holding most of us back from being great traders.

According to my calculations, the utility breakdown of these services is as follows (for every ten subscribers):

Forget about their subscription as I do with The Economist: 2

Think they’re learning and manage to get lucky in the process: 3

Quickly realize the service is a waste of time: 5

Are super excited about Adam Neumann’s new venture: 8

Lose money over most time frames: 9

Would be better off subscribing to a paid version of this Substack: 10

It’s not that all retail trading is bad. Some such traders manage to do well, making them exceptions to the rule (though I would still question the persistence of those results). And there are plenty of retail investors who responsibly budget a small sleeve of their portfolios for fun, which is all well and good.

But there are many more who have convinced themselves of capabilities that simply do not exist. They spend hours in FinX Spaces and hundreds of dollars per month on sham subscriptions, all the while trading the shit out of their portfolios while making themselves poorer - and Ken Griffin richer - in the process.

Even for the rare high-quality service offered in high-integrity fashion, it’s only making the problem worse given the false hope it provides.

But back to the menace at hand.

UW has evolved into the FinX version of those conspiracy troll accounts that are depressingly popular on social media. You know, the ones that post about Barack Obama murdering his chef or Jewish space lasers causing the Maui wildfires. These accounts seek to instigate through manipulation, routinely misleading their audience in pursuit of clicks. And it’s depressingly effective at attracting followers.

UW isn’t quite as wonton in its destruction of facts, but the account is nonetheless guilty of much hyperbole and misdirection. The most blatant example is its constant harpooning of American politicians for their trading habits. Indeed, UW’s primary claim to social media fame is in documenting the perceived injustice of our elected leaders profiting handsomely by trading on their insider knowledge.

You may be surprised to learn that reality paints a different picture. The fact is that politicians are no better than the rest of us when it comes to trading - nor is there any robust evidence of insider trading beyond contrived anecdote and insinuation - as has been demonstrated by academic studies as well as writing of my own.

But lucky for UW, most of us fall victim to confirmation bias - I mean, of course politicians are cheating! - so its antics serve as red meat for the unstudied masses.

I don’t mean to suggest that zero trading on privileged knowledge occurs within the halls of Congress. I’m sure it does. There is no disputing that politicians can be a deceitful and immoral bunch. But there is little evidence to suggest that the problem of insider trading is rampant in DC - or even all that profitable.

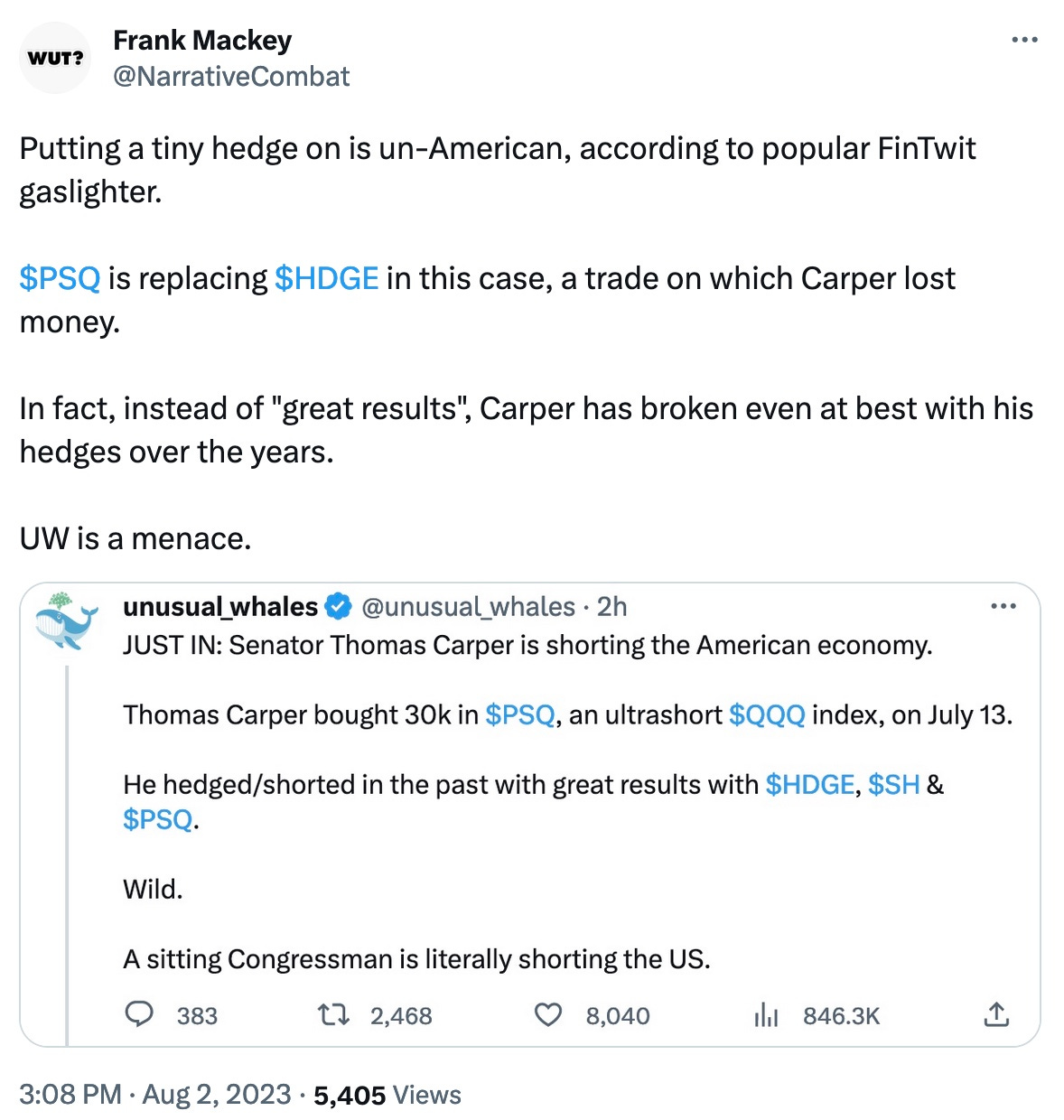

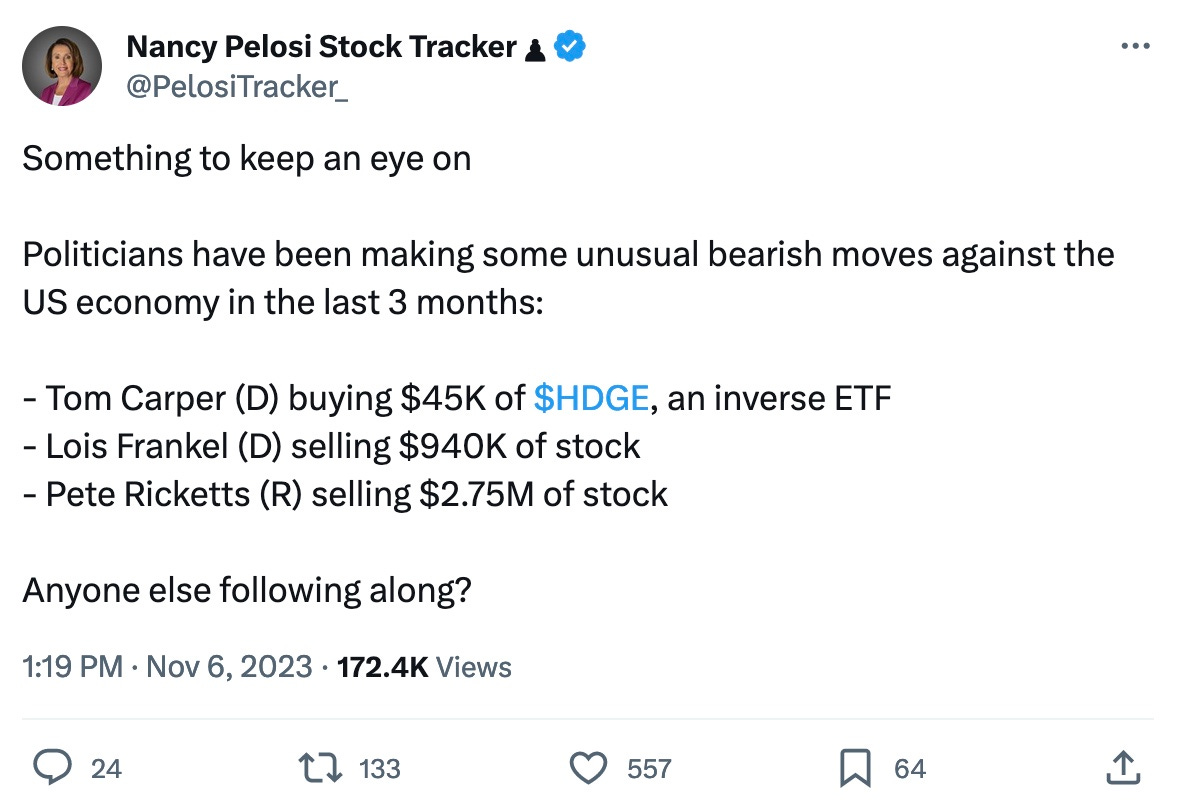

The below is a good example of UW’s vacuous attempts to foment discontent. The dramatic ending of “A sitting Congressman is literally shorting the US” is clearly an effort to piss everyone off. But it falls apart under the slightest bit of scrutiny.

UW’s popularity nonetheless persists since most of us can’t be bothered to check their work. This makes sense for a social media character who lives at the intersection of gullibility and motivated reasoning.

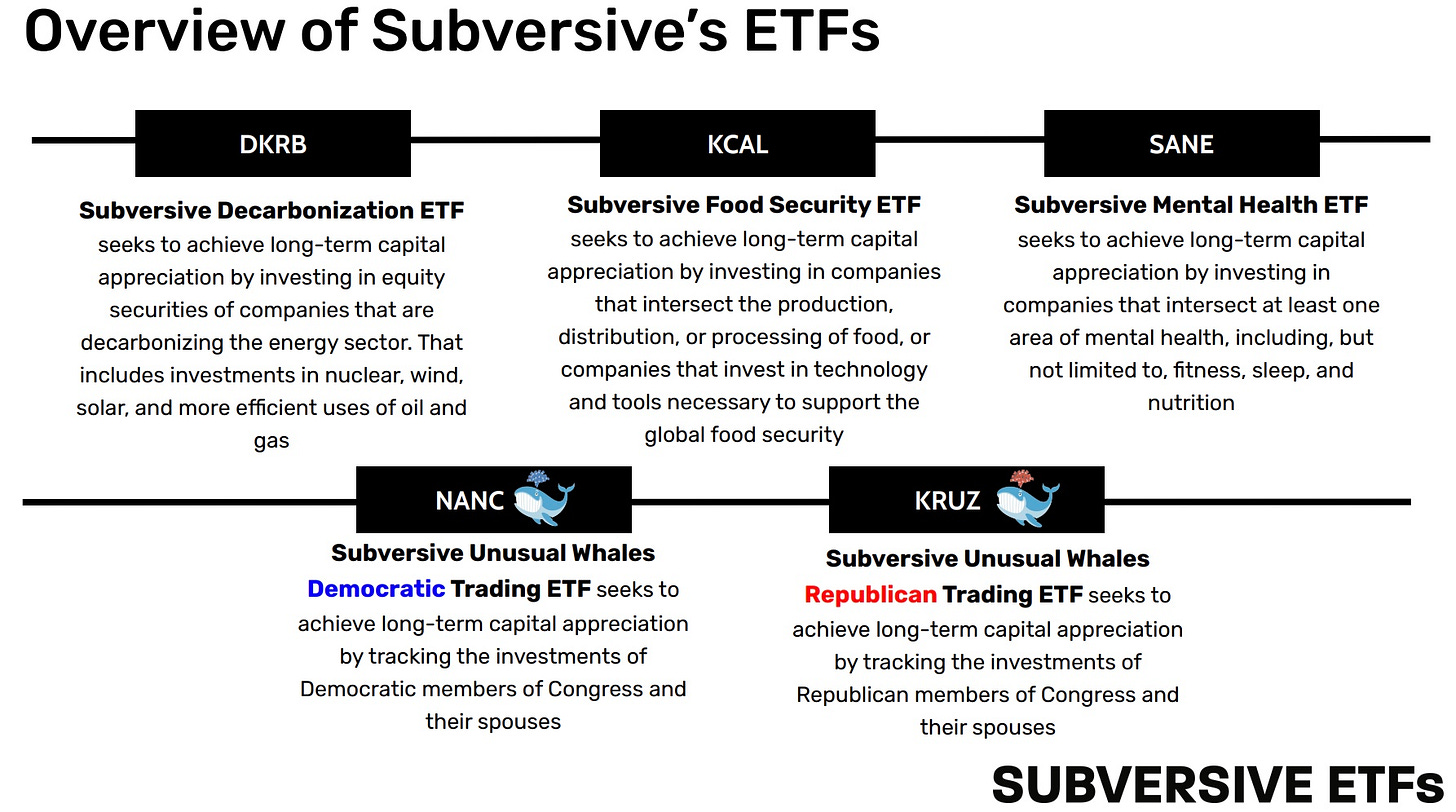

In a disappointing yet entirely expected development, a group called Subversive partnered with UW in early 2023 to launch ETFs that track the public investments of Democratic (NANC) and Republican (KRUZ) politicians.

Subversive appears to be a reasonably successful venture capital group, having made 29 investments since its founding in 2015. The firm was founded by Michael Auerbach, a modern-day Renaissance man who, in addition to serving as Subversive CIO, also performs the role of Head of Business Intelligence for Dentons Global Advisors as well as holding multiple directorships.

Looking to catch this new wave of gimmicky retail investment products, Subversive recently launched an offshoot called Subversive ETFs, which is “dedicated to investing in radical companies whose core missions subvert the status quo.”

The firm specializes in “mission-driven” ETFs, which is a creative way to describe thematic investment vehicles with no fundamental reason for being.

These products are off to smashing starts. KCAL and SANE were launched in December 2022 and declined -10% and -8%, respectively, from inception through 2023. This compared to respective gains of +23% and +40% for the S&P 500 and Nasdaq over the same period. These are tiny ETFs with barely $1 million between them, so I reckon they aren’t long for this world.

The firm’s latest product is a cannabis ETF launched in September (LGLZ), which came out of the gate with a loss of -20% against a +10% tape in its formative months.

Poor performance aside, one wonders why these products were developed in the first place. It’s hard to imagine many people sitting at their screens thinking, “My portfolio could really use some dedicated mental health exposure.”

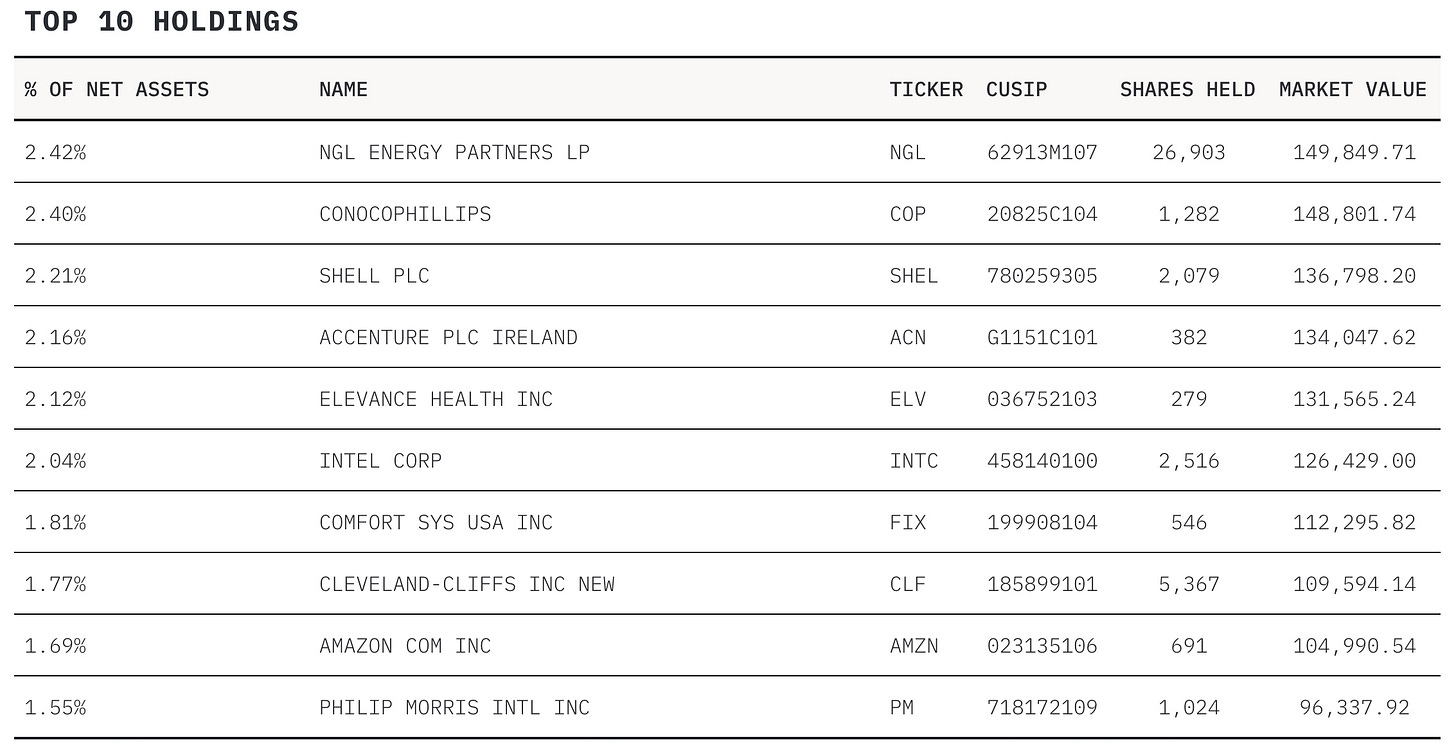

NANC and KRUZ round out Subversive’s roster of poorly-conceived ideas, products whose shortcomings were obvious from the start:

In addition to the conceptual flaws inherent to these vehicles (again, there is no evidence that politicians outperform as a group), there are functional limitations as well. For example, the STOCK Act mandates that politicians report their personal trades within 45 days of their execution date. Some eager beavers file the same day, while others take advantage of the full 1.5-month runway. The resultant lag - however long - is clearly suboptimal for any replication program.

Then there’s the question of trading instruments involved. Consider the case of Congresswoman Nancy Pelosi, a focal point for many commentators on this topic. It’s worth noting that much of Mrs. Pelosi’s trading success stems from the use of options (her husband, Paul, does the actual trading, by the way). You can see it clearly in UW’s own database tracking Pelosi’s trades. But guess what? NANC doesn’t trade options.

The list of issues goes on, including the judgment exercised around portfolio construction that results in a book with nearly 800 positions(!). Not to mention, any notion of risk management is being ceded to folks whose investment objectives are quite divorced from the average investor.

These products were created on the back of social media poppycock, built on a foundation of confusion. Their entire Genesis story stems from a faulty premise. These funds may luck into a bull market and therefore deliver on their generic objectives of capital appreciation, but there is no reason to believe that investors will do any better than the market over time.

Shifting from concept to practice, let’s see how these funds have acquitted themselves thus far.

From its inception on February 7, 2023 through yearend 2023, NANC generated a total return of +21% while KRUZ gained +10%. This compared to returns of +15% and +25%, respectively, for the S&P 500 and Nasdaq.

So the Democratic version has done relatively well while the Republican version has underperformed. An equal allocation between the two ETFs - assuming most of us lack the foresight to know which party is comprised of better stockpickers - would have an expected return of about +16% versus a combined expected return of +20% for the indices.

This is an admittedly short time frame to render a full judgment. But I reckon we’re directionally correct in our assessment of these products, which is that they’re the investment equivalent of bubble gum cigarettes.

Interestingly, NANC’s strong performance can be attributed to a heavy bias towards large-cap technology stocks, which led the stock market rally in 2023. These are among the most well-covered names in the world - and there hasn’t been any focused legislation enacted in well over a year - so it’s hard to imagine these Democratic politicians benefiting from any insider knowledge.

Meanwhile, KRUZ seems to have lagged its Congressional counterpart thanks to a preference for other sectors like energy, which meaningfully underperformed in 2023. Are we meant to believe that Republicans are less privy to all this privileged information floating around?

Thankfully, these funds haven’t caught on and will hopefully find their way to the ETF graveyard soon enough. As of this writing, KRUZ and NANC had only $6 and $13 million in respective assets under management.

UW isn’t the only culprit here, as the account’s antics have led to copycats. For example, there’s an X account called Nancy Pelosi Stock Tracker that has amassed over 350,000 followers. The account’s stated goal is to “get them banned from trading”, on which I’m here to call bullshit.

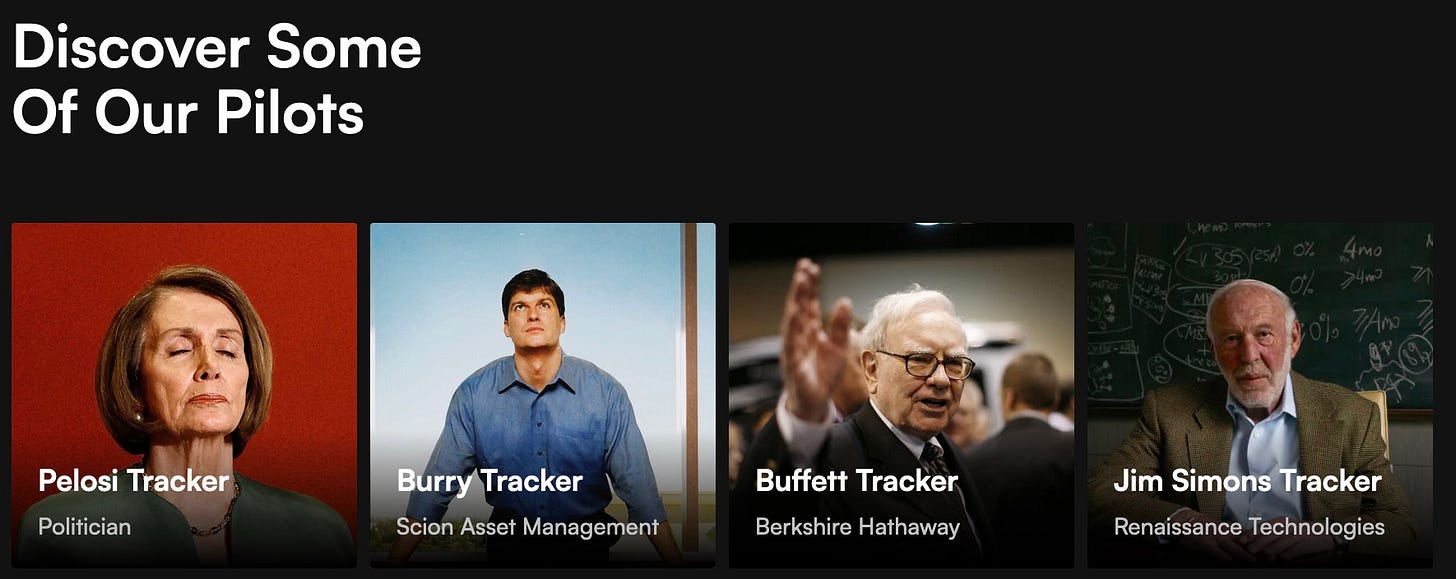

Not only does stoking the populist flame serve as a primary source of this account’s followership, but it also links to a trading app called Autopilot, which is a service that helps people copy the trades of certain public figures. This appears to be achieved by following 13F and Congressional disclosure filings of said figures.

Naturally, Nancy Pelosi is the leading tracker featured on the company’s website.

A Combat request for information about the Pelosi pilot indicated that the program is among the company’s better performers. So color me skeptical that this account is actually interested in politicians getting banned from trading. Golden goose and all.

As an aside, Autopilot was founded by a couple of young guys who appear to be startup enthusiasts with zero investment experience. This would explain why they consider it a good idea to replicate the 13F filings of Michael Burry - whose claim to fame is an unreplicable trade from 15 years ago that had nothing to do with stocks - and Renaissance Technologies - a quant portfolio containing thousands of long and short positions with average holding periods of two days. Autopilot doesn’t copy shorts and RenTech’s long book would’ve turned over like 20x by the time its latest 13F filing dropped.

In any event, these guys are having fun stoking mistrust in service of their latest entrepreneurial pursuit. But similar to UW, it’s easy to see through the smoke.

Using data from Capitol Trades, we can see how the game is played by these accounts. Let’s take Senator Tom Carper as an example. The Pelosi Tracker dude (let’s call him PTD) thinks that Carper’s purchase of $45,000 worth of an inverse ETF is unusually bearish. This is disingenuous framing for several reasons.

First, HDGE is not an inverse ETF. Rather than being programmatically designed to generate inverse price action of a reference index, HDGE is a short-biased fund driven by fundamental stock selection.

Second, the size of these trades is reported as a range. In this case, Carper made three separate HDGE purchases of between $1,000 and $15,000 each. PTD uses the upper end of that range for dramatic effect since, well, Carper purchasing $3,000 of something would just hit different.

Also missing here is important context. Latest estimates suggest that Carper has a net worth of at least $6 million. Even assuming most of that is comprised of real estate, a $45,000 hedge is small beans (noting further that this appears to be replacement exposure for PSQ, making HDGE the extent of the senator’s hedges).

You’ll also notice that Carper’s been actively buying T-bills. Purchasing sovereign debt is typically associated with some degree of risk aversion, but such exposure is most definitely not a bet against the issuing country.

These are obviously ridiculous products and services that have no business staying in business. Their time will come. For now, we can join Mr. Market in greeting these abominations with a collective eye roll…and some Combat treatment to boot.

Stay tuned for the next installment in this series, which will focus on the entirely unnecessary injection of politics into ETF construction. This will be followed by a review of some of the more “reputable” names in the space…and maybe a little something more.

In the immortal words of retired Army Lieutenant Colonel Frank Slade:

what about the mess with Blackrock Crypto ETF their planning to launch Jan 3, 2024?

Not sure I'd call it a mess but yeah there's plenty to write about it.