George Noble and the Hypocrisy of FinTwit Cancel Culture

Being wrong is a cancellable offense for thee but not for me.

The game of history is usually played by the best and the worst over the heads of the majority in the middle. - Eric Hoffer

George Noble is an investment industry veteran in the midst of a career renaissance. After years spent in relative quietude managing his own money, he recently burst onto the Financial Twitter (FinTwit) scene as an outspoken critic of certain Wall Street characters and behaviors. A man mostly known in veteran hedge fund circles is increasingly becoming a household name, and his small Twitter account with limited engagement a short six months ago has since ballooned to over 35,000 followers.

Mr. Noble got here by capitalizing on today’s populist moment and reinventing himself as a righteous crusader looking out for the little guy. Making savvy use of social media, he is now the self-appointed arbiter of all that is good and bad in the investment world. Those who fall afoul of him incur his wrath in writing as well as video…and lots of people are watching.

In his crosshairs are the supposed stars of this latest everything bubble, which can generally be described as the bull market for risk assets that has prevailed since the 2008 Global Financial Crisis but especially so following the COVID crash of March 2020. Mr. Noble has publicly identified a handful of individuals whom he believes have been behaving irresponsibly. He takes every opportunity to heap scorn upon them for their perceived misdeeds, even creating his own Hall of Shame for their names to grace.

In addition to those named above, Mr. Noble’s hit list has grown to include RealVision cofounder Raoul Pal, crypto investor Nic Carter, contrarian macro strategist David Hunter, Tiger Global founder Chase Coleman, and likely a host of others. He has promised these individuals that he will become their worst nightmare.

Mr. Noble seems to be enjoying his newfound fame. He’s more active than ever on Twitter, hosts his own Spaces discussions and pinned a recent Forbes piece on his crusade to his Twitter profile.

With all the buzz, I couldn’t help but do some research to better understand our new hero. What’s his story? What’s he like? And why is he doing this?

What I discovered is a man who is a walking contradiction. Someone who:

pleads for civility in discourse while regularly excoriating those who dare disagree with him;

bemoans ad hominem attacks yet routinely hurls insults himself;

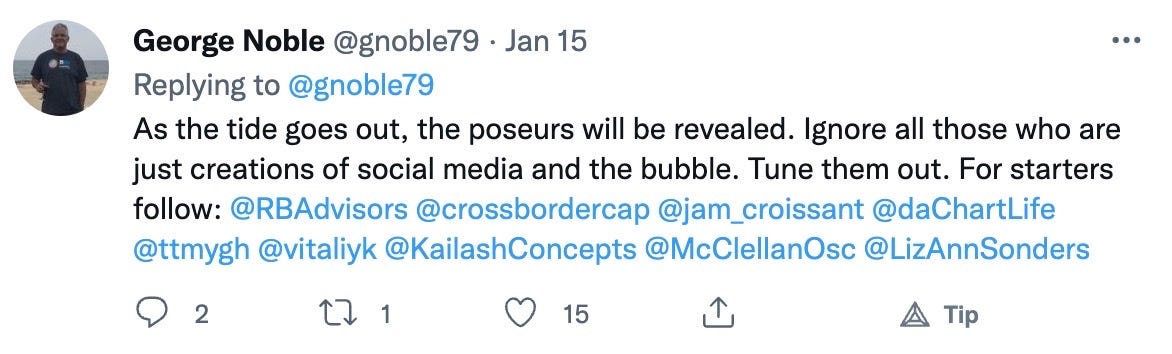

laments creations of social media when it appears he used one of them to elevate his own profile;

claims altruistic intentions when his campaign of righteous indignation may have commercial motivations; and

uses social media as a bully pulpit to disparage others for being wrong despite being wrong many times himself.

Mr. Noble began his career in 1981 as an analyst at Fidelity Investments. His formative years were spent working for the legendary Peter Lynch before becoming the first Portfolio Manager of the Fidelity Overseas Fund (FOSFX) in 1984.

Mr. Noble’s performance was strong during the early part of his FOSFX tenure, outperforming his category (Foreign Large-Cap Growth) by an average of 18% per annum for the period 1985-1987 (per Yahoo Finance). This strong start included a 79% gain in his first year at the helm (versus a peer group average of 59%), which made FOSFX the top-performing mutual fund in America in 1985.

This put Mr. Noble on the investment world map and remains his calling card to this day. It also provides a peek into the man’s personality and possible insecurities. The fact that he once managed the top-performing mutual fund in America is very important to him as it features prominently in his Twitter profile and history. An archive search of “#1” or “number one” returns dozens of instances where he is found reminding people that he used to be a big deal. He even once bragged that he could run six miles in under 36 minutes while boasting of his moment in the sun those many years ago.

That inaugural year with FOSFX would end up contributing almost half of all the gains achieved during Mr. Noble’s six years at the helm. The latter part of his FOSFX tenure was indeed less impressive, underperforming his category by roughly 5% per annum for the period 1988-1990. FOSFX would continue to underperform in 1991, not all of which can be attributed to Mr. Noble since he departed the firm early that year to launch his first hedge fund, Teton Partners.

Similar to the early success he achieved with FOSFX, Teton appears to have capitalized on a good start - and likely too Mr. Noble’s past affiliation with Mr. Lynch - to become one of the first global equity hedge funds to reach $1 billion in total assets under management (AUM).

Also echoing his FOSFX experience, Mr. Noble’s success with Teton was relatively short-lived, as he reportedly returned investor capital in 1996 “after a period of weak performance”. Since Teton was a private fund, we do not have access to its returns to render a full judgment. It’s also not uncommon for struggling managers to shutter their funds to “spend more time with family”, and for his part Mr. Noble referenced a sickness in the family as motivation for the shutdown.

After some time away, Mr. Noble returned to the hedge fund game in 2005 with a fund called Gyrfalcon. Here again he appears to have had some early success as his new fund also eclipsed the $1 billion AUM mark. But that too was short-lived. According to multiple news reports, Mr. Noble returned investor capital in 2009 after his fund incurred a 30% loss during the first several months of that year. Being down that much always hurts, especially when juxtaposed against a roughly equivalent gain in equity markets.

Commentary regarding the Gyrfalcon shutdown indicated that Mr. Noble planned to retool his investment strategy and raise capital for yet another go. Entertaining such an idea requires a special sort of chutzpah that Mr. Noble appears to have in spades. Getting a second bite at the apple in the hedge fund game is rare enough. A third go-round is virtually unprecedented, which may explain why he doesn’t appear to have made it to market with a third fund.

Mr. Noble instead spent the past decade-plus managing his own family office, Noble Capital Advisors, and has become increasingly active on Twitter in recent years.

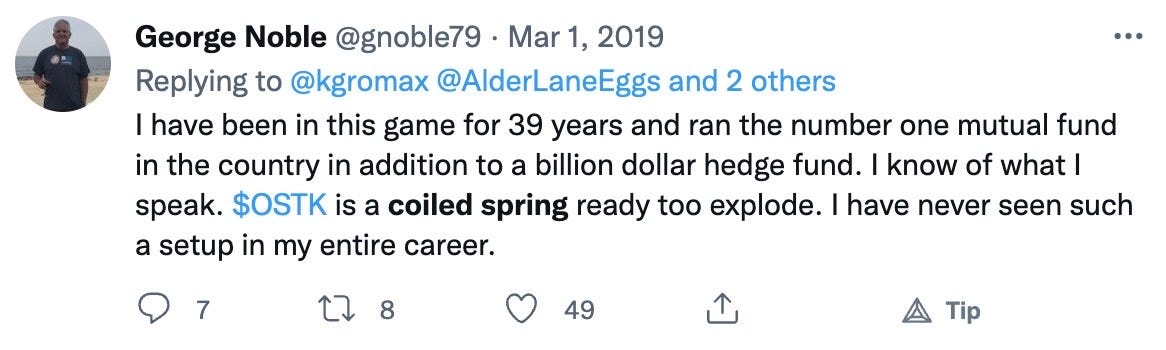

His account (@gnoble79) was established in 2010 and lay dormant until 2017 when he posted an Oprah Winfrey meme about stocks going up. A couple of shots at Tesla followed before things started to pick up in the summer of 2018. After a brief dalliance with MiMedx (MDXG), Mr. Noble moved on to Overstock (OSTK).

He posted multiple bullish OSTK tweets over the following months, many of which focused on the stock’s short interest. Such constituted the majority of his feed, save for the occasional musing that provided us a preview of his signature pugnaciousness and braggadocio.

During the twelve months following his original tweet, OSTK declined roughly 60% while the NASDAQ rallied approximately 25%. The stock fell even further in the COVID bust and rallied hard along with everything else in the recovery, so we’ll just remove that episode altogether.

To be fair, there appears to have been some chicanery involved on the part of OSTK management that may inform the stock’s terrible performance. But investment losses don’t care about excuses and I doubt Mr. Noble has much patience for them himself.

Mr. Noble would spend the next couple of years on Twitter dipping in and out of conversations, many of which were markets-focused - especially energy - but also sometimes opining on politics or the dangers of COVID-19.

We got an early taste of his antagonism, hypocrisy and poor prediction skills with the following tweet:

Funnily, the minute I challenged Mr. Noble he blocked me too. It appears he makes liberal use of the block button and has remarkably thin skin for someone who operates with the sharpest of elbows. A review of commentary from those blocked often reveals their sins as simple disagreement or mere suggestions that Mr. Noble be more civil in his interactions. It’s almost as if he’s cultivating the type of echo chamber he often warns about.

Meanwhile, FB (+76%) and AMZN (+96%) would go on to outperform the Nasdaq (+68%) over the 18 months following the above tweet while BABA underperformed (+10%). Of course all three stocks are struggling now but being early is the same as being wrong.

One of my favorite examples of Mr. Noble’s cocksure nature is the following tweet:

Mr. Ubben is the founder of ValueAct Capital, a $14 billion activist fund that has been around since 2000. I reckon it’s safe to say Mr. Ubben has proven the more successful fund manager when compared to Mr. Noble.

This thread from December 2021 is another good example of Mr. Noble’s duplicity and trademark self-assuredness. It’s on the topic of the Omicron strain of COVID-19, about which Mr. Noble was highly concerned.

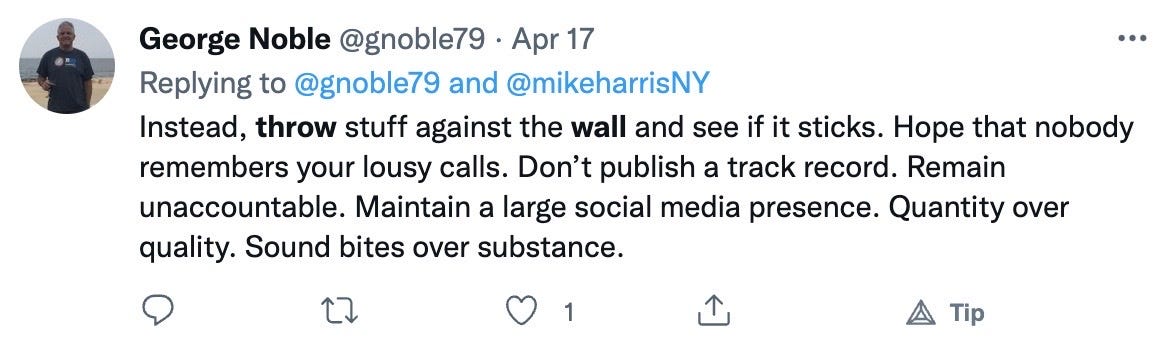

It appears Mr. Noble deleted his original tweet - perhaps because his certainty was in fact undeserved - but thankfully Mr. Young kept receipts. Turns out there are numerous references to Mr. Noble deleting tweets that proved incorrect. Given the crusade he has embarked upon, one would think that accountability might be something Mr. Noble treasures. Instead, he only occasionally speaks in broad strokes about ever being wrong and that’s typically when he’s otherwise being praised. He claims transparency about his mistakes but the only one I’ve seen him own is the one he can’t hide: the demise of Gyrfalcon. A Twitter keyword search of “wrong” and “mistake” returns dozens (if not hundreds) of tweets that feature him telling others how wrong they are with only a handful that generically reference his own faults.

(A cynic might read projection into this man’s desire to call someone arrogant, wrong and nasty.)

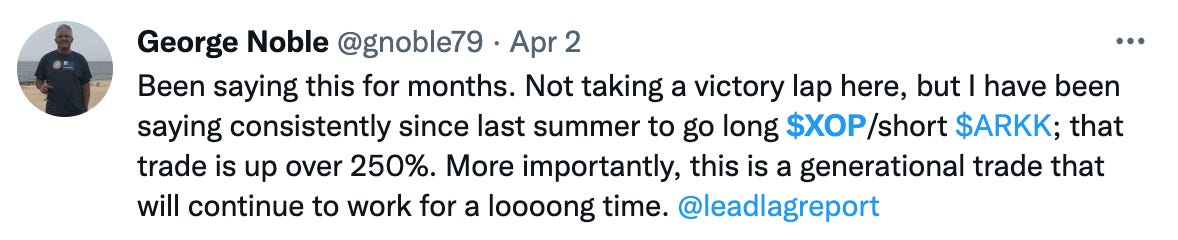

Mr. Noble has surely gotten plenty of things right over the course of his career. One doesn’t raise two $1 billion-plus hedge funds and amass enough personal wealth for their own family office without scoring plenty of victories along the way. And to his credit, he’s had good calls on Twitter as well, the most impressive of which would appear to be a long XOP/short ARKK pair trade.

From what I can tell, he never explicitly recommended this exact structure, at least not in writing. But we’ll give him credit nonetheless since he was directionally correct on both names individually. Mr. Noble was also decidedly bearish risk coming into 2022, which is turning out to be quite prescient.

The foregoing is not meant to suggest that Mr. Noble has been uniquely wrong or right throughout his career, but rather that people are sometimes wrong and sometimes right. Naturally, the longer they’ve been doing something, the more examples of both. It’s therefore curious that Mr. Noble so eagerly crucifies others for committing many of the same types of mistakes he’s undoubtedly made himself.

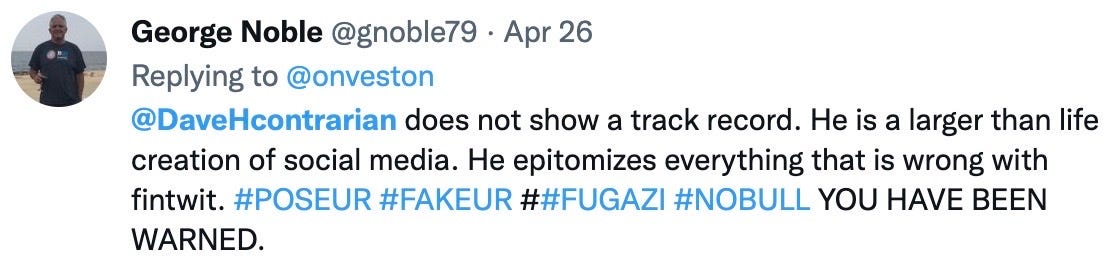

Let’s now examine the tendency of a man who laments personal insults to routinely levy such attacks himself. Indeed, Mr. Noble regularly complains about Twitter interactions turning ad hominem, especially when engaging with parts of the crypto community. Yet any objective assessment of his own behavior reveals an individual known more for his bullying than even-tempered engagement. Naturally, this contradiction is lost on him: When he resorts to name-calling, it’s just him expressing his opinion. When others do it, it’s an ad hominem attack and therefore a blockable offense.

A cursory review of his Twitter feed returns numerous examples of Mr. Noble’s hypocrisy on this topic. The man makes common use of the terms charlatan, liar and carnival barker to describe those with whom he disagrees. He even went so far as to describe the richest man in the world some combination of these things.

According to Mr. Noble, Larry Kudlow is an idiot. So is Paul Krugman. Those investing in NFTs are ignorant morons. People who don’t agree with him on the much-maligned stablecoin Tether are naive or stupid. Alan Greenspan is a putz who has reserved himself a special place in hell. Elon Musk is a dishonest, self-aggrandizing snake oil salesman. The stupidity of Alexandria Ocasio-Cortez is mind-blowing. Jerome Powell is clueless, ignorant of financial history and lacks intellectual integrity. JC Parets is a liar and horrible investor. Dr. Anthony Fauci is an educated ignoramus.

Then, of course, there’s Cathie Wood:

Perhaps the best example of Mr. Noble’s lack of self-awareness is a Spaces discussion he hosted a few weeks back, during which a target of his - the aforementioned Nic Carter - was brave enough to enter the lion’s den for a live debate. What Mr. Carter quickly learned is that to debate Mr. Noble is to be screamed at by him (something Tether CTO Paolo Ardoino learned as well). But in the process Mr. Carter expertly picked his antagonist apart, unmasking our newfound hero to reveal a bitter, incoherent ball of agitation and grievance.

Mr. Carter, a bitcoin enthusiast, joined the discussion to challenge Mr. Noble’s hyperbolic assertion that he had blood on his hands, presumably resulting from crypto’s brutal performance over the past several months.

This was an interesting fight for Mr. Noble to pick. Putting aside the fact that bitcoin has been a wildly profitable investment over longer time frames, Mr. Carter is a formidable adversary. While prone to mistake (like us all) and the occasional exaggeration, Mr. Carter himself is no shrinking violet. He is also among the more sober and thoughtful voices one will encounter in cryptoland. I’m no fan of the bitcoin maximalism of which Mr. Carter is perhaps guilty, but he is not the toxic variety that might justify the broadside assault that Mr. Noble launched against him. Instead, what I see in the accused is a gifted communicator, as articulate as he is composed, who is not only insightful but also measured in his rhetoric. In other words, the antithesis of Mr. Noble.

The conversation started with the false promise that Mr. Noble would be respectful. That sentiment was quickly betrayed as our belligerent moderator proceeded to accuse Mr. Carter of being macro-unaware, hyperbolic, sensationalist, likely to be relegated to the dustbin of history (another Noble insult favorite), and, of course, a carnival barker. He also leveled an insult by association while mentioning Mr. Carter in the same breath as Mr. Pal, whom Mr. Noble so respectfully described as a “scumbag”. (Mr. Noble would add to the insults by later calling Mr. Carter naive, ignorant and dishonest in one tweet and a sanctimonious faux erudite cheerleader in another.)

Mr. Carter handled the barrage with aplomb, calmly addressing the host’s aggression with considered and reasonable responses. As someone used to dominating debates through browbeating boorishness, Mr. Noble was easily felled by someone more his measure. Anyone listening to that “debate” with an objective ear would clearly see one side behaving in childish, emotional fashion after having their argument dissected in real time and it wasn’t the crypto guy.

The best I can tell from the mangled mess of Mr. Noble’s accusatory grandstanding is that Mr. Carter is guilty of the crimes of being popular and bitcoin bullish. Seeing an opportunity to point out the conflicted nature of those accusations, Mr. Carter asked Mr. Noble - who apropos of nothing reminded Mr. Carter that he worked at Fidelity longer than him - whether he was aware who runs Fidelity and what her view is of bitcoin (noting Fidelity has created an entire division dedicated to espousing the benefits of bitcoin called Fidelity Digital Assets). Rather than recognizing the flaw in his attack, Mr. Noble instead felt compelled to remind everyone that he is friends with Fidelity’s CEO, Abigail Johnson, revealing yet again a boastful instinct that comes naturally to him. And instead of acknowledging the disharmony with his claims against Mr. Carter in this context, Mr. Noble instead began foaming at the mouth while accusing his opponent of phantom sleights of hand and strawmanning.

Mr. Noble also claimed that Mr. Carter had a responsibility to fair and balanced reporting and accused him of failing to consider the null hypothesis of bitcoin. The dissonance on display here is remarkable. Mr. Noble himself is clearly not fair and balanced with his malicious musings about bitcoin nor does he make a habit of considering his own null hypothesis when it comes to crypto.

It was also fascinating to listen to Mr. Noble admonish Mr. Carter for not listening. Mr. Carter understood the conversation very well, it’s just that he responded in a manner that was embarrassing to the moderator. One can easily detect that this is a regular defensive technique employed by Mr. Noble. When his arguments are challenged effectively, he resorts to yelling and misdirection rather than mature, introspective discourse.

Interestingly, Mr. Noble prematurely abandoned and subsequently deleted that Spaces discussion. He attributes his early departure to a meeting he had to attend and the deletion to Mr. Carter adding no value to the discussion. I trust you’ll forgive my skepticism about his motivations here. Thankfully, someone recorded the discussion and posted it in the above YouTube clip (which comes in three parts), allowing the rest of us to judge for ourselves.

Let’s now investigate how we arrived at Mr. Noble’s social media renaissance. Towards the end of 2021, he began to actively engage with a Twitter account called Lead Lag Report (LLR). The account is run by Michael A. Gayed, a self-proclaimed thought leader who publishes an investment strategy newsletter and manages a suite of tactical investment funds.

I discovered Mr. Gayed the same way I suspect many others did, which was through an aggressive Twitter marketing campaign that made it feel like every other tweet was one of his promoted ones.

Mr. Gayed’s marketing campaign proved wildly successful (he looks to have started a new one as well). He now has over 650,000 followers on Twitter and hosts daily Spaces discussions that tend to draw a decent crowd.

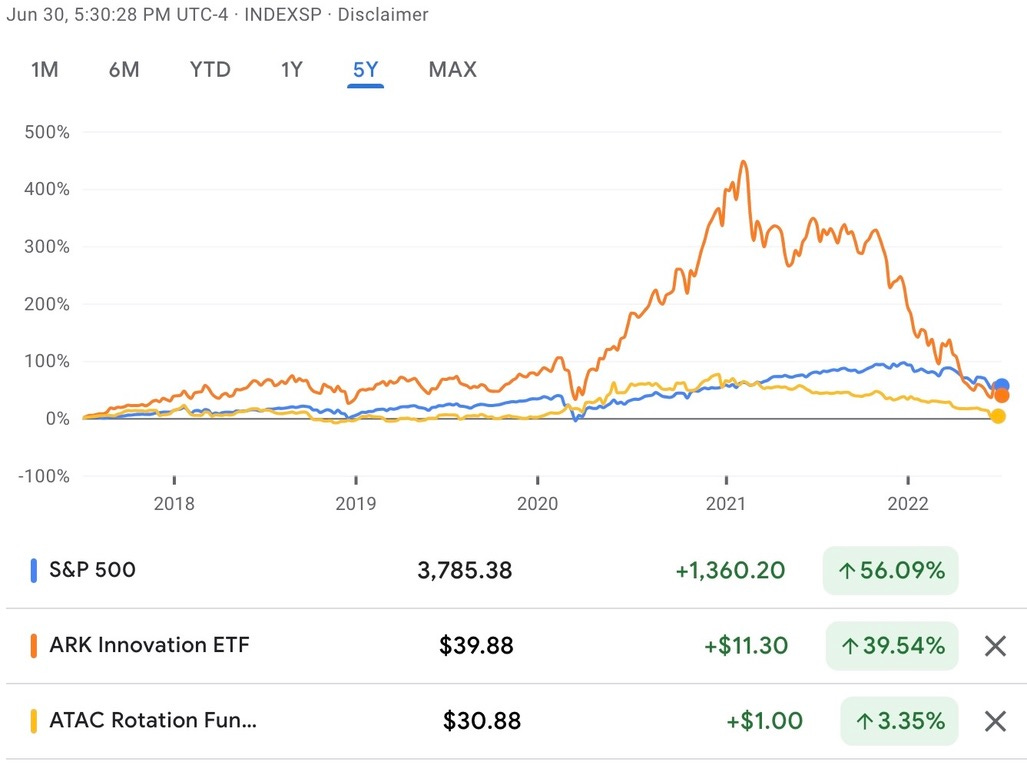

From what I can surmise, Mr. Gayed is better known for his social media exploits than for his investing chops. His flagship mutual fund - the ATAC Rotation Fund (ATACX) - is rated three stars by Morningstar and has generated a 21% cumulative return since its inception in 2012 versus a 175% gain in the S&P 500 Index (per Google Finance, through June 2022). The fund is down 26% in 2022 versus a 21% decline in the S&P 500.

Mr. Gayed also manages two ETFs through Toroso Investments - the ATAC US Rotation ETF (RORO) and the ATAC Credit Rotation ETF (JOJO). RORO is down roughly 28% since its inception in November 2020 (versus a 7% gain in the S&P 500) while JOJO is down 24% since its inception in July 2021 (versus a 10% loss in the S&P 500).

The combined assets of these products is just over $100 million as of this writing.

A study of Mr. Gayed’s tweets reveals similar levels of disingenuousness witnessed with Mr. Noble. For example, he never misses a chance to dunk on crypto, tweeting so often about the asset class that one would be forgiven for assuming it was part of his fund mandates (it isn’t). I can appreciate the psychic benefit a struggling fund manager might enjoy by making fun of another group of investors doing worse than him. We all deal with underperformance in different ways; his appears to involve some combination of deflection and schadenfreude.

To be fair, some crypto enthusiasts are deserving of all that smoke given their behavior online (“have fun staying poor”). The space is characterized by lots of silly behavior and has performed atrociously this year. But the desire to obsess over an asset class that has nothing to do with one’s focus is rather odd.

Mr. Gayed also shares a flair for the hypocritical with Mr. Noble. For example, in one breath he’ll shame his critics by suggesting that people should “be kind” while in another breath:

His criticism of crypto is also pretty rich in light of this comment from about a year ago (when the asset class was seeing much better days):

By December, Mr. Noble began to regularly copy Mr. Gayed on his tweets. He would also go out of his way to compliment his aspirational friend.

This is a curious stance for a man who loathes creations of social media, which is precisely what Mr. Gayed would appear to be. How else would someone of his stature - an unaccomplished investor who regurgitates banal economic/market statistics that are interspersed with sarcastic takes on crypto - have more followers than accomplished investors like Bill Ackman and Jeffrey Gundlach?

It is difficult to envision many hedge fund luminaries assigning a moment’s worth of attention to the likes of Mr. Gayed. His background isn’t particularly compelling nor is he a proven moneymaker. I don’t mean to suggest that the man is unworthy of all attention. He is intelligent, a strong communicator and clearly an effective marketer. But he lacks the pedigree and track record to move the needle for most serious investors. The disconnect is most pronounced with fundamental equity managers since Mr. Gayed is a top-down market technician concerned with the interplay between things like lumber and gold rather than a bottom-up investor interested in discounted cash flows. And his funds are model- rather than research-driven.

So why would an old school, fundamental stock-picker - a man who probably counts himself among investing royalty - become so eager to engage with a small, underperforming systematic fund manager?

Urban Dictionary defines a clout chaser as “a person who strategically associates themselves with the success of a popular person…to gain fame and attention.” Could it be that Mr. Noble’s courtship of Mr. Gayed was designed to elevate his own profile? This would certainly explain his otherwise inexplicable reverence for Mr. Gayed as well as his newfound tendency to tag other popular accounts in his tweets.

Whatever the true motivation, Mr. Noble’s engagement with Mr. Gayed proved successful since by mid-December he was participating in LLR Spaces discussions. Lo and behold, Mr. Noble’s follower count began to explode shortly thereafter. The next thing we know he’s holding court with his own Spaces discussions and becoming a social media personality himself. He now goes so far as to copy large media platforms and personalities like CNBC, Elon Musk, Barack Obama, Ray Dalio and Joe Rogan on his tweets, presumably on the assumption they might care about what he has to say. His aspirations appear to be as grand as his personality.

Source: SocialBlade

As a quick aside on Spaces, Mr. Noble is awfully proud of his. They are of course the best that can be found ANYWHERE. With, naturally, the best moderation. (I must say his boastfulness reminds me a certain former American president.)

It should be apparent to everyone that these sessions are obviously marketing efforts. Messrs. Gayed and Noble now host them regularly, with topics and guests spanning the investment spectrum. Mr. Gayed sometimes even hosts multiple ones in a day.

It’s hard to imagine the average retail investor listening to any of these discussions and having the faintest idea of what they should do with their own portfolio afterwards. Rather than going down the rabbit hole on oil or being told how the world is coming to an end, most retail investors would benefit more from tuning all this noise out and staying the course. They’re likely best served by following Warren Buffett’s advice, which is to simply get long the market as cheaply as possible and do nothing else. Even for those looking to be a little more active, they probably just want to know whether they should be invested or not. These Spaces discussions are therefore more mental masturbation for industry professionals than they are a public service for average retail.

The evolution of Mr. Noble’s online personality got me wondering whether there could be a commercial motivation to it all. Early indications suggested that might not be the case. In fact, Mr. Noble used his newfound power for good, encouraging listeners of his Spaces discussions to donate to charity as a show of support. He appears to have crowdsourced over $200,000 in donations for World Central Kitchen, the wonderful organization started by chef Jose Andres to help feed those impacted by humanitarian disasters. I applaud Mr. Noble’s initiative here.

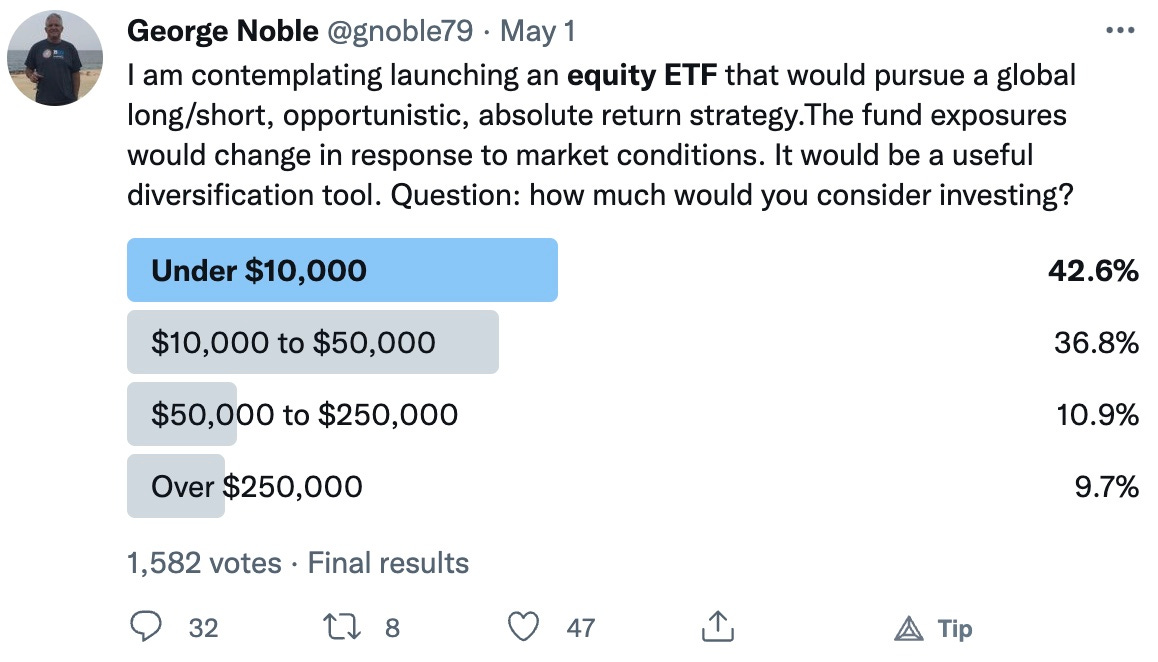

However, a more recent development seems to confirm my initial suspicion.

That recent Forbes feature said the quiet part out loud when it referenced Mr. Noble’s coyness on ways he might “monetize” his newfound fame. And sure enough, it looks like he’ll parlay his popularity into a fourth bite at the fund management apple. But instead of another hedge fund, he’ll be launching a global long-short equity ETF in partnership with - surprise, surprise - Mr. Gayed’s Toroso Investments.

It could be that Mr. Noble is doing this out of the kindness of his heart, that his investment brilliance must be shared with a world hurting for access to quality financial products. In which case we can surely expect a fee structure well below industry averages. Or will it be richly priced like Mr. Gayed’s products, which carry relatively high expense ratios for underperforming, “set it and forget it” strategies? I guess we’ll find out soon enough.

Now that we’ve gotten to know more about Mr. Noble’s background and personality, let’s now circle back to his “noble” crusade against the aforementioned individuals.

I sympathize with the disenchantment that may come with certain of these characters. For example, I’m of the opinion that what Michael Saylor has done with his treasury at Microstrategy is absurd and I tend to agree that Chamath Palihapitiya is of the raccoon variety that the great Ben Hunt has euphemistically described.

I’m less concerned by some of the others. Let’s start with Messrs. Cramer and Pal. Both make lots of mistakes and likely do little to help the average investor given their wayward musings. Yes, Mr. Cramer is more than a little disingenuous given his admission that he only invests in index funds rather than individual stocks, which is the lifeblood of his show. And he is plenty responsible for the gamification of stock trading amongst retail investors. For his part, Mr. Pal has done himself no favors with obfuscation regarding his crypto activities leading up to the current bear market. But neither of these gentlemen is dispensing professional investment advice. Though both have experience as hedge fund managers, their public personas have become more entertainer than investor. They are showmen cut from the same cloth as Tucker Carlson and Rachel Maddow. In just the way folks shouldn’t go to Fox News or MSNBC commentators for astute and objective political commentary, they shouldn’t go to Messrs. Cramer or Pal for investment advice. They should instead enjoy the performance - which is often thoughtful in Mr. Pal’s case - and do their own research before taking any action.

We then have the likes of Mr. Hunter, a strategist perhaps best known for his call that equity markets will soon experience a dramatic melt-up that will be followed by a catastrophic collapse.

Two things stand out to me here. First, strategists/experts are wrong all the time. Given their collective track record, our interest in their views probably stems less from confidence in their accuracy and more from the rationales behind their predictions. For example, FinTwit enjoys giving Scott Galloway a hard time for his many missed calls, but his ideas rarely come half-baked. He tends to frame his various hot takes in an eloquent manner that gives us something to think about regardless of outcome. Lucky for us, he’s brave enough to continue making those calls despite the blowback he receives online.

The same applies to talking heads at ESPN, the Wall Street Journal, the New York Times and all of cable media. We of course shouldn’t forgive blatant lies, blatant partisanship, lazy analysis or outright misinformation. And it’s totally reasonable to point out trends in wrongness. But earnest attempts to predict the future should always be graded on a curve.

Mr. Hunter is similar to Mr. Galloway in that he provides interesting analysis to go along with his calls. He also maintains the courage of his convictions even when markets move against him in the short term. His now infamous melt-up call would certainly appear to be floundering and I appreciate frustration with his refusal to concede defeat. But markets are complex and dynamic, so predictions related to them should call for accuracy over precision. In any event, it strikes me as a stretch to assign ill intent to his work, no matter how wrong he might prove to be with it.

This criticism is made all the more disingenuous by the fact that Mr. Noble himself is now in the prediction business. The majority of his tweets and Spaces discussions now feature him selling doom and gloom to his growing legion of followers. If his bearishness is proven incorrect, should we break out the pitchforks for him as well?

The shots taken at Ms. Wood and Mr. Coleman are most germane to this discussion as they represent what I believe is the philosophical impetus behind Mr. Noble’s charade.

It seems evident that Mr. Noble views himself as a stock-picking purist. Old-fashioned things like valuation matter to him. I suspect he watched with dismay the enormous success enjoyed by the likes of Tiger Global and ARK during the everything rally. My guess is that he attributes most of their success to luck rather than skill. They’ve been handsomely rewarded more for punting beta by being directionally correct than for generating alpha by being fundamentally sound, as evidenced by his desire to call Ms. Wood a “narrative chasing beta merchant”.

I reckon these investors have failed his purity test and the extraordinary riches attained by them are therefore ill-gotten. Conversely, the losses now befalling them are richly deserved. This would also explain Mr. Noble’s distaste for bitcoin, which cannot be valued in any traditional sense yet has generated extraordinary profits for amateur traders since its founding.

The vitriol being directed towards Ms. Wood is particularly disturbing. It’s one thing to challenge her investment theses and criticize her recent performance, which is fair and perhaps justified. It’s entirely another to go full ad hominem. A quick search of Twitter and YouTube sees all manner of insults being hurled her way. Bullshit artist, moron, charlatan, quack, liar, criminal, fucking nuts. Many of these Mr. Noble has used himself, again from a man ostensibly worried about the lack of civility in today’s discourse.

The following conversation from Mr. Noble’s YouTube channel is a good example of this disconnect. Its first portion is spent lambasting all things ARK and Cathie Wood before waxing philosophical on macro and markets. It is wonderfully emblematic of the man’s many contradictions, which seem to be shared by his merry band of acolytes.

There are a couple of good quotes here, firstly from Mr. Noble:

So now she’s a yield curve expert (in reference to a CNBC clip where Ms. Wood discusses 2/10 inversion). The whale oil queen who was calling for $12 oil. That oil peaked in 2019…she’s now pontificating about the slope of the yield curve. Are you kidding me?!?!

Here we have a career stock jock deriding a former economist for discussing the yield curve. Ms. Wood’s first job was as an assistant economist at Capital Group. This was followed by serving as Chief Economist at Jennison Associates for 18 years before becoming Chief Investment Officer at AllianceBernstein.

This criticism is made all the more disingenuous since Mr. Noble spends most of his time these days pontificating on monetary policy, commodities and currencies rather than idiosyncratic stock picks. As a reminder, Mr. Noble is not a trained economist nor has he served in that role in a professional capacity.

Here’s another quote even richer with irony:

Hubris was considered to be amongst the biggest of sins. It’s the complete lack of humility.

Mr. Noble made this statement when complaining about Ms. Wood’s lack of a public mea culpa. Putting aside the ridiculousness of this statement in light of Mr. Noble’s own monumental ego, the reality is that portfolio managers talk their books all the time. Reasons for this could be noble (they genuinely believe what they say) or ignoble (they are just trying to convince investors to stick around). I reckon this is a predicament quite familiar to Mr. Noble given his background.

None of us can know what Ms. Wood believes deep in her heart. But if she’s been anything it’s consistent in her belief that innovation will change the world. She is therefore delivering on precisely what she advertises to investors in terms of mandate. I’m sure everyone would prefer her performance to have been much better these past twelve months. But for someone who thinks in five-year cycles, this drawdown might not be catastrophic for her. It certainly doesn’t appear to be that troublesome for her investors, who continue to invest in her flagship ETF, ARKK, despite its recent losses. Granted, she has made some outlandish claims about return expectations and her research might not be robust enough for the likes of Mr. Noble. But to assign nefarious intent to it all can say more about the accuser than the accused.

It’s also important to recognize that drawdowns don’t typically occur in isolation. There are often exogenous factors that influence fund returns. In the case of ARKK and Tiger Global, those factors include an aggressive rate hiking cycle that has crushed the growth stocks that figure prominently in their portfolios. Just as being exposed to the growth factor worked splendidly over the past few years, we are now witnessing its opposite effect as highflying technology stocks come crashing back to earth. So while the absolute returns witnessed over the past year have been dismal, they should be considered in the context of an unwelcoming macro backdrop that has sent relevant benchmarks tanking.

Let’s dive into that dynamic in more detail.

There’s no disputing that ARKK is in the midst of a terrible run of performance. After posting a stellar 157% return in 2020 - which included a trough-to-peak rally of 300% from the COVID bottom - the fund has since declined 67% versus a roughly 11% fall in the Nasdaq Composite Index (through June 2022). This year has been especially difficult with ARKK now down about 58% versus a 30% decline in the Nasdaq. Relative performance is particularly relevant for long-only funds, and ARKK’s relative underperformance of 56% versus the Nasdaq over the past 18 months is noteworthy.

As an aside, ARKK’s returns since inception (+102%) have still outperformed ATACX (+19%) despite the former’s current drawdown. The five-year chart frames this nicely.

Source: Google Finance.

Based on various reports, Tiger Global lost 7% in 2021 versus a 21% gain in the Nasdaq. The fund was reportedly down another 50% in 2022 through June, which compared to a 30% decline in the Nasdaq. All told, this equates to relative underperformance of roughly 38% over the past 18 months.

As hedge funds are intended to be absolute return in orientation, benchmarks do not typically apply and relative returns are theoretically immaterial. But we all know most investors measure hedge fund performance in both risk-adjusted and relative terms.

So how does the relative underperformance of ARKK and Tiger Global amidst their largest drawdowns compare to Mr. Noble’s track record of the same? Since we don’t have his performance to analyze in full, we’ll have to extrapolate from publicly-available data (making this an imperfect exercise but hopefully close enough).

As previously mentioned, news reports indicate that Mr. Noble closed Gyrfalcon when the fund was down 30% in a stub year 2009 that saw the S&P 500 up 30% over the same period. The MSCI World Index - likely the more appropriate benchmark for Gyrfalcon given what I presume was a global equity mandate - was up closer to 40% during that time. That equates to relative underperformance of 60-70%, which exceeds that seen with Tiger Global as well as ARKK to date.

Measured in these terms, Mr. Noble’s Gyrfalcon meaningfully underperformed his growthy counterparts during their respective drawdowns. Given their collective AUM, Mr. Noble has asserted that the magnitude of the ARKK and Tiger losses is much greater in dollar terms. But in doing so he is penalizing those funds for their prior success in attracting that AUM when their relative drawdown performance appears to have outperformed his own.

This of course matters little to Mr. Noble and his righteous crusade, which works on sound bites rather than nuance. He’s gone so far as to suggest that Mr. Coleman should return investor fees because of his latest run of losses. As a hedge fund manager himself, Mr. Noble understands very well the absurdity of this request. But his commentary is calibrated for clicks rather than clarity, so practicality won’t stop him from grandstanding on the topic.

This can only lead us to wonder whether Mr. Noble reimbursed Gyrfalcon investors for the fees they paid in exchange for his massive underperformance in 2009.

None of this is to suggest that Ms. Wood and Mr. Coleman don’t deserve some of the heat they are receiving. Their recent performance certainly calls into question not only their research capabilities but also what if any risk management protocols may have been in place. And I agree with concerns about how hybrid funds like Tiger Global might be marking their private positions.

Nor is any of this to suggest that Mr. Noble lacks ability as an investor. He may be an excellent one. Rather, the point is simply to demonstrate that investing is hard. The hedge fund game can be particularly cutthroat. It’s rare that funds demonstrate any real persistence to their performance over time. The hope is that investors are profitable from start to finish, which I believe remains the case for both Tiger Global as well as ARKK despite their drawdowns. As someone with a lumpy return profile of his own, Mr. Noble should appreciate this reality.

It’s therefore a shame to see Mr. Noble play to the cancel culture ethos that has become prevalent in today’s society. Everyone is getting upset about everything it seems. I suppose it’s possible that Mr. Coleman and Ms. Wood have perpetrated a massive fraud against everyone. It’s also possible that Ms. Wood and Mr. Coleman are terrible investors. Or, more likely, it could be that they run aggressive funds that are predictably struggling in this type of environment but will bounce back when the earth doesn’t get eaten by the sun and growth returns to favor.

More to the point is that nobody is forcing anyone to invest in these vehicles. As an established hedge fund, it stands to reason that the majority of Tiger Global’s investors are large, sophisticated institutions. And ARKK’s investor base is almost equally comprised of institutional and retail investors.

There’s an old Hollywood saying that (paraphrased) says an actor is only as good as their last picture. I reckon this is the ghost that Mr. Noble is chasing and he’s adroitly manufactured a chance to slay that demon. But at the rate he’s gaining enemies through his wanton display of indignation, his new ETF might eclipse ARKK as the most heavily scrutinized in history. One false step and the boo-birds will come out in force. He’ll learn soon enough that schadenfreude works both ways.

This should be good fun for those of us aware of the game being played here. The result will either be a tip of the cap to someone who managed to pull it off or a wag of the finger at another flameout that in retrospect was entirely predictable.

This is really well written, and it summed up perfectly what I, and I'm certain plenty of others in Fintwit who often join both of their Spaces, have been thinking and saying quietly to ourselves for quite some time.

Thoughtful writeup, and great reminder to stay humble.