Investment Fund Nonsense

On the gamification of investing in private fund form.

There was a fun series of Holiday Inn Express commercials a few years ago that featured characters performing functions beyond their core competencies. A nerdy white dude with unexpected rapping chops. Some random guy performing surgery. A birthday party clown masquerading as the rodeo variety. Each character manages to pull off their improvisation because they “stayed at a Holiday Inn Express last night".

These commercials came to mind when a reader introduced me to something called Fund Launch. Formerly known as Investment Fund Secrets (IFS), Fund Launch is an online course designed “to help others start their own funds in a world where people believe you need Ivy League credentials or Wall Street experience to break into.”

You may have heard of Fund Launch already given its aggressive marketing campaign. For example, the following ad was in heavy rotation leading up to the World Cup.

The Fund Launch offering can be summarized as follows:

This nicely sets the tone for the comedy that ensues when one begins to peel the Fund Launch onion. A ridiculous and unverifiable statement (beats Ivy Leaguers 90% of the time?!?!?) followed by sensationalistic verbiage (HERO TEAM!), value anchoring (EASILY worth some arbitrary price) and horrific copy editing (If you want to…making easily avoidable mistakes).

Allow me to establish some bonafides before proceeding. I come to the topic of private investment funds with a fair amount of expertise. I’ve analyzed, invested in, and launched private funds of my own over the course of my two-decade career. This makes me intimately familiar with the investment fund life cycle. I’ve also rubbed elbows with some of the most successful hedge fund, venture capital and private equity managers in the world. And I’ve been associated with the rare multi-billion dollar success story as well as the more typical emerging manager failure.

I can therefore speak with some authority when I say that the Fund Launch premise - that anyone can and should start their own fund - is completely absurd.

Look, starting a private investment fund is a costly and laborious process. There is certainly room for a service that makes the fund launch experience cheaper and easier. However, to suggest that the logistics of it all is the primary gating mechanism for aspiring fund managers is naive at best and disingenuous at worst.

Call me crazy, but it’s my belief that a 25-year old personal trainer-cum-Robinhood day-trader probably shouldn’t start their own long-short equity hedge fund. And no, a 35-year old medical equipment sales rep probably shouldn’t launch their own real estate debt fund.

I don’t mean to shit on the dreams of others. There is certainly nothing wrong with being aspirational and optimistic about the future. But some things are best attempted when armed with the requisite know-how and resources.

What’s remarkable about the world today is our increased willingness to believe that expertise can be won so easily. With hundreds of millions of Twitter users, blogs and podcasts, the democratization of information dissemination and consumption has formed a gestalt that gives rise to a collective false bravado. Despite an obvious lack of knowledge or experience, we’re suddenly all experts on pandemics, geopolitics, China, crypto, military strategy and oil prices. The steady stream of information we are subjected to forms a cacophony of hot takes that leaves us feeling smarter than we actually are about a range of topics.

To paraphrase Andrew Keen from his book The Cult of the Amateur, “what the [social media] revolution is really delivering is superficial observations of the world around us rather than deep analysis, shrill opinion rather than considered judgment.”

Investment management is particularly susceptible to manufactured hubris. The free money era that followed the Global Financial Crisis made it seem like investing was easy. It’s hard to look dumb amidst an everything bubble when it’s all a one-way beta trade. This surely informed the rise of the retail trader and punchy new asset classes like crypto. The resultant gamification of investing made it seem like anyone could be a winner, especially when housing-related wealth effects made us feel even flusher.

This environment has cultivated all manner of get rich easy schemes. Paid Substacks and Discord channels offering generic investment advice. FinTwit trading gurus who are somehow always right and lack any accountability. Bespoke research services from “former hedge fund managers”. All promising to help subscribers and followers make it big in the investment game. This can all be accomplished “even though you don’t know what you’re doing”.

Here’s my take. If you’re a good investor or fund manager, you’re probably not creating an online course to teach others how to do what it is that you’re doing. You might write a Substack for shits and giggles as a creative release or maybe have a Twitter account to troll and poke fun. But you are certainly not giving away any of your secret sauce for subscription fees. That’s because you’re too busy making real money doing things like actually investing. But if you’re not actually making money investing, you might be inclined to push another “related” product that can generate fees. Sadly, the consumers of such products often fail to detect sophistry.

The best place to start on our Fund Launch journey is to learn about the people behind this whole production.

The company was founded in late 2019 by two young BYU graduates: Bridger Pennington and Mason Vranes. Bridger is the CEO and face of the firm. In his telling, he’s the one who came up with the original idea after brainstorming with his father about his future. As fate would have it, Bridger’s father is John Pennington, cofounder of a successful real estate investment firm called Bridge Investment Group.

In an interview with the gullible and easily impressed Caleb Guilliams - who describes himself as a financial prodigy and the New Face of Finance - Bridger talked about the Fund Launch genesis story in some detail.

It all started for Bridger after a fateful meeting with his father’s business partner, who was kind enough to impart the secrets of the wealthy. Turns out that secret is managing investment funds.

We’re told that Bridger has long had an entrepreneurial itch to scratch. He apparently started six businesses in his first two years of university, which included selling essential oils, real estate, and online marketing services. The Fund Launch epiphany was therefore a welcome one for a young guy trying to make his way in the world.

So Bridger set about learning as much as he could about the fund management business, presumably guided along by his father and mentor. He even managed to launch a couple of funds of his own in the process. His first two funds appear to have been called Bridge Grow Fund I and Bridge Grow Fund II that operate under the banner of Black Bridge Holdings. Per the latest regulatory filings, all I could confirm is that Fund II had raised $652,000 as of June 2020.

Bridger more recently launched a small crypto fund called Ugly Unicorn. I could go on for pages about what a ridiculous proposition this fund appears to be, but for now trust me when I say it includes one of the worst pitch decks I’ve ever seen.

What Bridger appears to have taken away from his learnings is that anyone can launch a fund, all they need is a little help in navigating the whole setup process. No prior experience is required and god forbid anyone come to Fund Launch with an Ivy League degree. Bridger in fact notes that those possessing fancy degrees are prohibited from coming on his show or participating in the Fund Launch journey.

Instead, Bridger only works with entrepreneurs who have taken the “unconventional route” to fund management. He even goes so far as to suggest that he’s heard from Ivy Leaguers who went the conventional route (investment banking or working at other funds) and regretted their decisions once they learned of the Fund Launch offering.

A cynic might doubt the truthfulness of this story while speculating that Bridger avoids more experienced practitioners because they’re able to call bullshit on the Fund Launch value proposition.

But Caleb is no cynic. He’s instead enamored by the pitch and thinks Bridger is “literally giving people machines to print money”. Oh young Caleb, my sweet summer child.

It’s easy to see why Bridger plays the role of hypeman. He’s handsome, articulate and energetic. And he speaks with his hands like most showmen do. As Catherine Jinks once noted on the topic of charlatans, “he is perhaps too voluble and demonstrative in his gesticulations.”

Bridger’s cofounder, Mason, is a marketing specialist who appears to play a more behind-the-scenes role. This makes sense once we get to know him, as he presents a more socially-awkward version of motivational speaker and coach.

It looks like Mason got his entrepreneurial start a few years ago with a marketing brand named EMVI that was followed by something called onepercenter. At the core of the onepercenter offering appears to be some sort of coaching regimen that offers up a handful of secrets to help athletes maximize their potential.

Mason has a video about secret number one that was filmed in 2018, which was followed by a couple more videos revealing additional “secrets” to performance. The impetus for onepercenter seems to have been Mason’s own lack of basketball prowess. While growing frustrated with his inability to progress on the basketball court, Mason discovered a formula for success that involved mastering the mental side of the game and then sought to monetize that breakthrough.

He reportedly trained players for $8,000+ to be their personal mentor, all of whom we’re told ascended to become division one collegiate athletes. Mason suggests that, without the oncepercenter, not only will we never become division one athletes but we will also have unsatisfying careers. Thankfully, Mason can help us 10x our game without any extra physical training.

It’s safe to assume our guy Mason is full of shit here. For starters, we’re left to wonder why Mason himself never became a division one athlete since he managed to master the mental side of his game. And I’m willing to bet if he had 75 athletes sign up for his program - all of whom were guaranteed to 10x their game within six months - his YouTube videos would garner more than 25 views and the onepercenter would still, you know, be a thing.

But we can nonetheless learn a little bit about the Fund Launch playbook with Mason’s early efforts. The below screenshot does a decent bit of work in this regard.

A few things worth noting here. First are the obvious sales tactics. His “cheatsheet” appears to be a double-sided laminated piece of paper that includes some mumbo jumbo with four “secrets” attached. All we need to do is pay $4.95 for shipping.

It obviously doesn’t cost that much to mail a light, letter-sized envelope, so he’s capturing the spread as profit. Moreover, this is a well-known marketing tactic used to gather contact details that extend beyond email addresses to include phone numbers and home addresses (since his cheatsheet could easily be shared over email).

We also have the little trick of charm pricing. For example, members get early access to the trademarked 1%er Mentality course (no such trademark ever existed, by the way), which we’re told is valued at $995 rather than the bigger round number of $1000.

And, of course, we have more terrible copy editing: “The #OnePercent will help you to…show you how to train your mind to a world class level.”

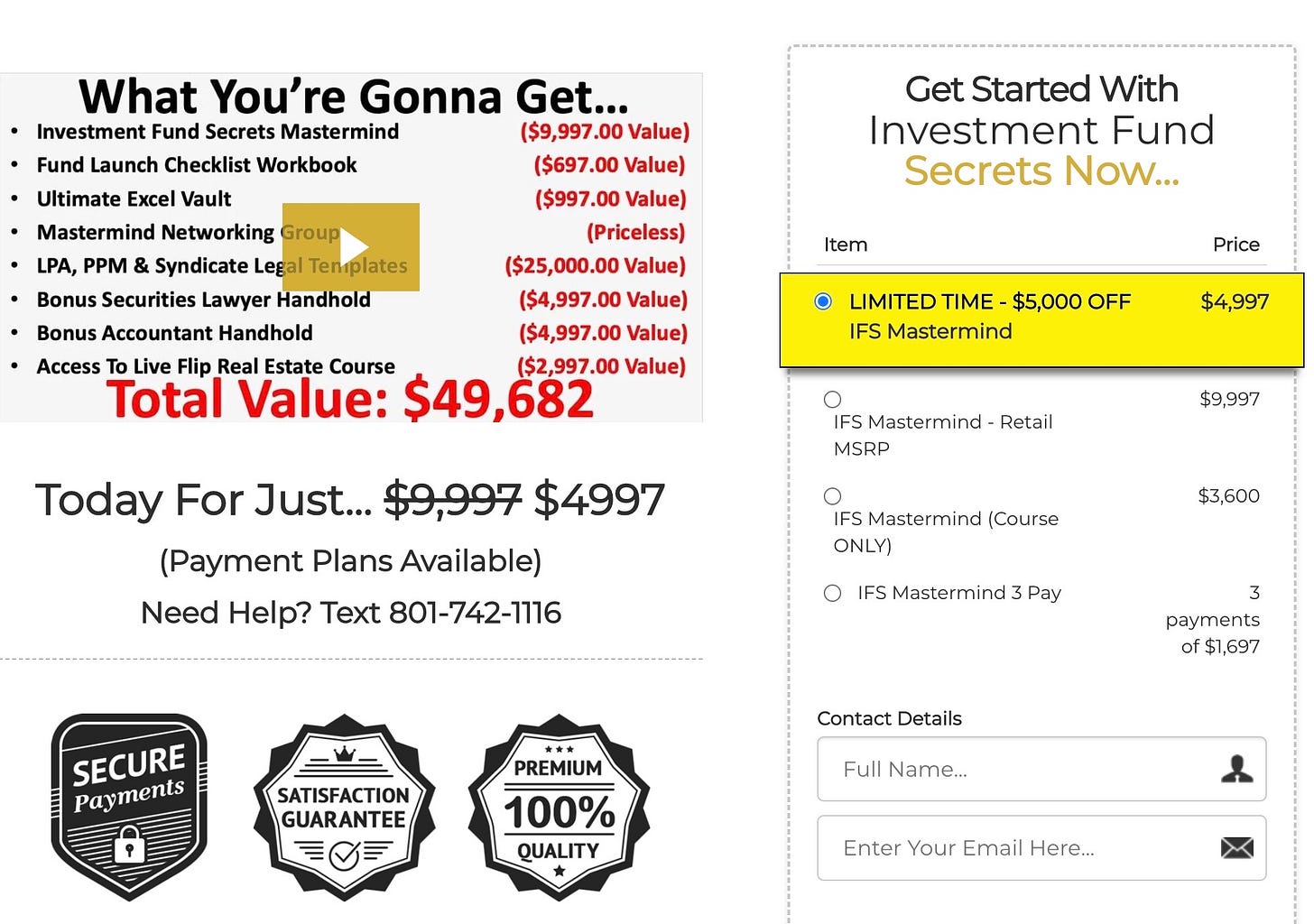

This framing looks familiar when we explore pricing options for Fund Launch:

Per his personal website, Mason is a “marketer chasing mastery” and he’s got a number of videos that describe his journey. Signing up for Mason’s intro video earns you a free “non-pitch” consultation (another marketing trick), which we’re told is valued at $997. That’s funny because an annual subscription to Narrative Combat is also valued at $997, but lucky for you I’m nice enough to give this all away for free.

Accessing Mason’s video requires that you input your email and he thankfully promises no spam. I haven’t given my email address to any other website so figured I’d give Mason a try. It’s been one week since I gave him my email and my spam folder has grown from zero to 173 messages. This could be a coincidence…or maybe not.

Mason’s intro video is a 20-minute soliloquy about his struggle with entrepreneurial failure. It feels like confessional catharsis presented in teenage angst form. The revelation for Mason - set against dramatic music - came in discovering that he could rewire consumer brains to make them more willing to buy his product. He “started mastering how the brain works…the codes and sequences” to arrive at a form of neural rewiring that not only worked for his onepercenter clients but would also presumably work on his Fund Launch prospects. Mason realized he’s “gotta give people new stories to believe in”, so why not partner with Bridger to convince people they should be launching their own funds?

Another guy that pops up a lot in Fund Launch videos is Lincoln Archibald. Like his colleagues, Lincoln is a couple years out of school with a bit of a random background. Per his LinkedIn profile, he looks to have graduated from product development manager at Fund Launch to now partner and CFO (with zero apparent experience in finance or accounting).

It’s fascinating to watch Lincoln hold court on topics with which he has little experience. There are many examples of such ridiculousness, ranging from videos that mis-explain hedge fund incubators (no fund manager in their right mind would give away 80% of their economics to a seeder) to comically amateur descriptions of what a pitch deck should look like.

In another video, Lincoln discusses how establishing a fund can be a solution for an entrepreneur looking to raise money without giving up equity.

You can start a separate entity, like a business, you can raise money in that business - from investors - then you can invest that capital into whatever means you see necessary. Right. The method of a fund is turning $1 into $2, by taking capital, investing it and getting a return. That’s a business! Businesses are about taking money, providing a good or service and getting a return back to your investors.

The logic here is fascinating to consider. I don’t want to give up equity in my used pogo stick business and I’m allergic to any form of debt financing. So what I’ll do instead is start a fund - which I’ve never done before - and convince some people to invest in that fund, which in turn will only invest in my pogo stick business.

As owner of this fledgling pogo stick empire, I’ll be able to benefit from capital infusion into a business that will spin off profits for me. And my fund investors will benefit because…um…uh…they own a piece of the profits in my business? Hold on a second, that kinda sounds like I gave away equity in my business!

Adding: I’m no securities lawyer, but this sounds an awful lot like an affiliated transaction, against which I’m pretty sure there are rules. The pitch really goes off the rails at about the 4:30 mark but I encourage readers to watch the whole thing for maximum effect.

There is no evidence that Lincoln has any practical experience with the issues he discusses. As far as I can tell, he’s never actually done any of this before. Maybe it’s just me, but I’d rather solicit this type of advice from someone who has actually invested in or launched, managed and grown funds of meaningful size.

Lincoln is also serving as Chief Investment Officer of a firm called Black Card Capital Partners. Given that the company’s LinkedIn page describes itself as “connecting emerging managers with qualified investors”, it sounds like this is a third-party marketing firm. There is no website for the company and Lincoln appears to be the only person affiliated with it (though he lists himself as cofounder). Why a placement agent would require a CIO is beyond me (since it’s a marketing business rather than an investment one), so I suspect some title inflation is occurring here. More interesting is the fact that neither Black Card nor Lincoln is registered, which is strange since receiving compensation for capital introductions is a regulated activity.

The below video provides a good general introduction to what was then called Investment Fund Secrets. It also provides plenty of quotable commentary upon which to opine, which follows the clip.

Pretty much any business that wants to scale can use a fund to do this.

The notion of scaling one’s business with a fund comes up repeatedly throughout Fund Launch videos. This might make sense in some very specific niche use cases but it has nothing to do with the vast majority of funds in operation today. For example, Ray Dalio, Stephen Schwarzman and Ken Griffin didn’t start their funds to scale an existing business. Their funds instead became businesses that required scaling of their own. This is true for the overwhelming majority of funds in existence today.

Starting a fund is one of the most lucrative vehicles on the planet to make money.

It is true that successful fund managers can make obscene amounts of money. But it is also true that 99% of those attempting to achieve similar success will fail miserably. In fact, it is MUCH more likely that aspiring fund managers will ultimately make nothing. Most of them will actually lose money, both for their investors as well as themselves. The reality is that for every Blackstone there are thousands of fund management businesses that never amount to anything.

This is like saying becoming an actor is one of the most lucrative jobs on the planet. Sure, Brad Pitt makes a shit ton of money as an actor. But for every Brad Pitt there are thousands of careers that never advanced beyond the extras stage.

There’s a reason why almost every wealthy family on the planet uses a fund to scale their investments.

Family offices often utilize fund structures for their investments. But their decision to do so typically has nothing to do with “scale”. Instead, there are regulatory and tax considerations that serve as the primary motivation for managing their investments in fund structures.

If there’s one thing true about funds, it allows you to scale.

Again, this is an odd statement to make. There’s a separate video short of Bridger explaining how car washes are exploding around him and that his students could go to any of those owners with the idea of starting a fund to help them expand. This is an extremely rare use case for funds in the real world and makes zero sense for the bulk of fund management businesses.

You might be asking yourself, “Well, Bridger: What is a fund?…I don’t know what to start a fund for.”

If you’re asking yourself these questions, you should not be starting a fund. Period.

You don’t need to have it all figured out before you get started. I would actually argue the first step is learning about funds before you ever go start your own.

Always a good idea to actually understand what it is that you’re trying to do when starting any business. But even more important than having a good sense for what a fund is actual experience and expertise in managing said fund.

One of our students even called this the best investment he ever made.

In related news, one of my readers called Narrative Combat the best Substack he’s ever read.

Tony Robbins talks about this process in your brain that recognizes things you know about.

As aspiring motivational salesmen, of course we have a reference to Tony Robbins here. Bridger talks about how his business partner (Mason?) just bought a new Audi and how that caused Bridger to see Audis everywhere he went. This is a take on a psychological phenomenon called the frequency illusion and also a form of peacocking (showing the world how his business is making money). I’m not sure why someone would learn about starting a fund then see funds everywhere, but who am I to ruin the kid’s amateur attempt at framing.

Let’s now check out the success stories listed on the IFS website. Best I can tell, these stories were told back in 2020, so we have the benefit of time to judge their respective outcomes.

The testimonials start with the most interesting one from a gentleman named Gopalla C. This is a fun way to kick things off because Gopala is actually spelled with one “l” and his last name is Krishnan with a “K”.

Gopala (or GK) is the CEO of something called Nanban Enterprise, which we’re told is “one of the fastest-growing companies in the hedge fund space.” A visit to the company’s website finds a collection of different verticals and focuses that represent some combination of registered investment advisor, hedge fund, venture fund and philanthropy.

Judging by his background, Gopala appears to be a career enterprise technology executive who two years ago said fuck it, I’m gonna build an investment empire. For his hedge fund, Nanban Investments (Nanban), he describes his investment thesis as being about investing in broad U.S. market indices, which he says is the “safest way to invest in the stock market”. And on top of that, he uses “advanced derivatives to deliver superior returns, upper double digit every year on a consistent basis”.

The Chief Investment Officer for Nanban Investments is Sakthi Palani Gounder. A career IT consultant, Sakthi brings precisely zero investment experience to the table as CIO (which, to be clear, is totally fine so long as he lives at a Holiday Inn Express).

GK met Sakthi at a free seminar hosted at his house (as one does), shortly after which the two decided to launch a fund because “people are still stuck getting 8-10% returns”.

In a Fund Launch testimonial, Sakthi described the investment strategy that GK formulated as working “100% of the time in all market conditions” (insert massive red flag emoji). We’re again told they do this by investing in indices with “advanced strategies” to generate a superior return. We’re also told that downside is protected by buying portfolio insurance of some sort, so “your portfolio value will not go down at all” (insert larger red flag emoji).

Speaking of Sakthi, he was kind enough to provide an endorsement blurb on the IFS website:

Interestingly, some guy named Ed W. had the exact same sentiment to share:

How serendipitous!

GK says their hedge fund has an “asymmetrical risk profile” and “generates cash flow of 10% every quarter”. “We don’t make too much profit. Less risk but little more reward than the market. If the market makes 20%, we make 40-50%. So that’s why it’s a very good investment thesis that is resonating well.”

In his telling, GK started his “trading career” back in 1997. Per his LinkedIn, this would’ve been around the time that he was a Systems Developer at Mahindra Satyam. After a few years of experimentation, GK developed his world-beating investment approach in 2001. Tagged “GK Strategies”, the approach includes five strategies that he claims have been copyrighted under his name.

A cursory search of government records revealed no such copyright protection, probably because “copyright does not protect ideas, concepts, systems, or methods of doing something.” There appears to be a pending trademark application for “GK Strategies”, which only covers the name and not the secret sauce approach. Which means I could find a way to mirror his approach and call it FTJM Strategies with no repercussions.

GK says he has given away levels one and two of GK Strategies to friends and family at no cost (it was “charity-oriented”). But in order to do levels 3-5, “you need a minimum $2 million account”. No explanation is provided as to why someone would require $2 million to punt equity indices.

GK claims to have had 7,500 people following his strategies, which enabled him to raise $100 million for his hedge fund in just seven months (with, of course, much more in the pipeline). He also claims that demand is so high that he’s launching two 3c7 funds, each of which will have 1999 qualified purchasers.

A later video (on the same testimonial page) shows Bridger awarding GK the IFS 2020 MVP award, given to the program’s most outstanding student result. At this point, GK claimed to have raised $320 million for his hedge fund and $180 million for a real estate fund. He also noted that Nanban had a further $1.2 billion in soft commitments. He complained that he couldn’t take it all because of 3c1 limitations on the number of investors allowed in each fund (99), hence the desire to launch 3c7 versions in the future. At this point, he claimed to be running five funds in total.

Our gullible friend Caleb also interviewed GK and in the process ate up everything the world’s greatest fund manager had to say. The date of the interview was December 2, 2020, at which point GK claimed to have over $950 million in AUM. Young Caleb was impressed that GK “has a passion for investing in the market the right way…and doing the right thing”.

When describing his famous investment approach to Caleb, GK noted that “this works 100% of the time now”. Levels 1 & 2 allow people to generate returns of 18-30% on their own while levels 3-5 “take it to a completely different level…we consistently generate more than 100%”. We’re also told that “15,000 people have been following” GK and “have put their entire wealth into this.” GK also informed Caleb that his worst year since 2001 was +21%. And Caleb loves it all!

These are obviously ridiculous assertions but they’re nonetheless met with nodding agreement by the Future Face of Finance. Turns out there is a business angle here because GK claims to be encouraging his clients to invest into Caleb’s offering. (Caleb pushes something he calls The AND Asset, which appears to involve selling over-funded life insurance policies.)

GK went on to claim that he generated a 58% annualized return in his hedge fund, which for some reason is paid quarterly. To his credit, Caleb asked for a worst case scenario in a limp effort to build a bear case. GK answered that 3.5% is the maximum drawdown he’s ever incurred.

Fast forward to today and the rhetoric doesn’t quite map with public records. GK was previously registered with Nanban Capital, but that entity’s registration was terminated in July 2021. A visit to the FINRA Broker Check website reveals GK as “currently not registered” (CRD 7272906).

A visit to the Basic website seems to indicate that Nanban opts for exemptions to avoid NFA registration. This strikes me as surprising given the firm’s focus on “advanced derivatives strategies”.

Nanban Investments is currently registered as an Exempt Reporting Advisor with the SEC, which is what private fund managers do when their AUM falls below a de minimis threshold of $150 million. But I thought these guys were a $1 billion success story?

It turns out there are only two funds registered under the Nanban Investments name - the Nanban 2020 Perpetual Income Fund and the Nanban 2020 Oct Perpetual Income Fund - which as of March 2022 listed regulatory assets of about $40 million and $36 million, respectively.

The relatively low AUM is surprising enough, but also interesting is the fact that internal capital is listed at just 1% of fund assets. For someone who perfected a strategy that never loses money way back in 2001, I’d expect GK to have more than $750,000 to invest in his own funds.

GK also noted in several of his interviews that the minimum investment in his hedge fund was $500,000, yet his latest ADV put that number at $100,000.

The best part is that the funds have no independent auditor or administrator. This means there is no third-party verification when it comes to pricing the portfolio. GK could make up whatever he wants when it comes to performance and nobody would be there to correct him. I’m not suggesting that to be the case here. It’s entirely possible that Nanban performance reporting is totally legit. But if you told me someone prone to hyperbole has an over-subscribed strategy that never loses money and lacks any sort of independent oversight, then my spidey sense would be tingling.

Lastly, GK regularly makes mention of the charitable impact he seeks to make through his affiliated non-profit, Nanban Foundation, even claiming some percentage of fund profits are donated to it. A visit to the foundation website prominently features the GK Strategies as a core charitable offering for “fellow Nanbans”, with the next educational sessions scheduled for February 2023. Unfortunately, there are no records to confirm the foundation’s activities since it is not registered with Charity Navigator and no tax returns have been filed with the IRS.

It’s possible that the records I was able to access represent only a partial picture of the firm and its activities. I wrote into Nanban seeking information about its funds to conduct my own due diligence but never heard back.

I trust you’ll forgive me if I’m a bit skeptical about Fund Launch’s MVP student.

Next are the young fellas of Arrived Partners. They came to IFS fresh out of college looking for something “more”. We’re told that these whippersnappers were able to raise $10 million for their real estate investment project thanks to the secrets conveyed to them by Bridger and his dad. But their website now appears to be dead and LinkedIn shows only one of the three guys pictured to still be associated with the apparently defunct business. Again, no sign of any fund or business being registered with the SEC.

A testimonial from Jake G. follows. Jake is described as the founder of an opportunity zone fund out of St. George. Some light sleuthing revealed him to be Jake Gardner of the St. George Opportunity Zone Fund. The fund’s website is no longer active and its Facebook page (with only seven followers) was last updated in January 2021. It’s unclear what became of Jake since I couldn’t find a LinkedIn for him. There is a real estate agent of the same name in his neck of the woods but I’m not sure whether it’s the same person.

Then we have Eric Slaugh and Chase Kelly of Converge Capital Partners. It’s unclear whether a fund was ever launched by these guys given a lack of regulatory filings. But judging by their LinkedIn profiles, it would appear that Converge didn’t quite achieve liftoff. Eric is now in a sales role at a homebuilder and Chase is a Business Loan Champion at an SME loan originator, making Converge at best a side hustle of some sort. Hilariously, the website link included on the Converge LinkedIn profile now takes you to an Asian porn splash page.

Lastly, there’s Brent Mott. According to his LinkedIn profile, he is Director of Business Development for a firm called Bow Tie Capital. We’re told that his story “will only grow like crazy”. I have no idea how a story grows like crazy or why his brief testimonial is all that inspirational. But a visit to his website seems to suggest he’s doing OK, claiming to be on his way to $100 million in assets under management. It’s unclear what structure those assets sit in since there are no regulatory filings to confirm for either the firm or any fund it manages.

What I find remarkable about the Fund Launch offering is how flippant the team is when it comes to the fund management business. The idea that anyone can start a fund regardless of experience is like saying that anyone can perform surgery without proper education and training. Suggesting that all people need is some help with the setup piece is a little bit like saying to someone with no training or background in law, “Here’s all the paperwork you need to open your own law firm, now get out there and lawyer.”

That’s not to say that investment knowledge is as hard to come by as the medical or legal variety. But actually understanding what you are doing is of critical importance, especially when performing the function of fiduciary.

A good example of such flippancy is a podcast in which Bridger answers the question of how much to pay a capital raiser. In it, he describes the three circles of a fund being “investor expert person” - who is a “geek that sits in the basement trading options all day” - then the fund manager and a capital raiser.

Even more absurd than the equity split proposed (no chance 1/3 each works in the real world) is how dismissive he is of the engine that drives most investment firms, which is the investment piece. The majority of fund management businesses are started by an investor, someone with a perceived skill in stock-picking, trading or dealmaking. To describe the “investor expert person” as some geek in the basement doing “all that good stuff” is to demonstrate clear disrespect for the primary skill required to engage in fund management, which is the ability to actually manage money.

We have another example from Bridger’s chat with Caleb, in which he suggested that a $100 million fund can simply “write off” $100,000 a month in accounting software fees because “that’s an expense for the fund”. For the uninitiated, that’s an exorbitant amount to spend on such fees. Part of being a fiduciary is ensuring that reasonable efforts are made to keep a lid on fund expenses. In fact, many funds cap their expenses below a certain threshold, often well south of 1%. The idea of treating your fund as a piggybank and shelling out 1.2% a year on accounting software is equal parts irresponsible and naive.

What Fund Launch really is at the end of the day is one big sales job. These guys are pushing a product that, statistically speaking, is very likely to fail. This is true even if those launching a fund have a phenomenal pedigree, and certainly more so for those who come to the business with no experience at all. As the Fund Launch website disclaimer notes, “you should assume you will not have…any success at all.”

Much of the sales job lies in convincing ordinary folks that of course they can start a fund because anything is possible. This framing is in league with televangelists preaching the prosperity gospel and motivational speakers assuring listeners of the great potential that lies dormant within all of us. All we need to do is pay up for the inspiration and be on our way.

It’s therefore no surprise that Fund Launch events feature much pomp and circumstance. Bridger and his crew try to take the mundane practice of setting up an investment fund and dress it up all pretty like. One showman after another is trotted on stage to deliver motivational speeches to convince the inexperienced that a lack of expertise should not hold them back from chasing their fund manager dreams. Per Bridger, “If Pete Davidson can date Kim Kardashian, you can start a freaking fund!”.

Look, if someone needs to sell you on the idea of starting your own fund, you probably shouldn’t be starting your own fund. I’d be willing to bet that not a single success story will begin with the premise, “You know, I had never thought of starting my own fund - I mean, I didn’t even know what a fund was - but this guy Bridger convinced me that anything is possible and I’ve since built a $10 billion hedge fund empire.”

Like an electric baguette feeder, Fund Launch is a largely useless product destined to add way more value to its creators than its users.

I’m sure these Fund Launch guys are good kids at heart who are just trying to make it in life. I’m sure they mean well even if their company is likely to destroy value for clients. But I can’t help but think about the following anytime a Fund Launch ad pops up on my screen:

A charlatan is “a person practicing quackery or a similar confidence trick in order to obtain money, power, fame, or other advantages through pretense or deception. Synonyms for charlatan include shyster, quack, or faker. Quack is a reference to quackery or the practice of dubious medicine, including the sale of snake oil, or a person who does not have medical training who purports to provide medical services…The word comes from French charlatan, a seller of medicines who might advertise his presence with music and an outdoor stage show.”

Wow, great read! You must feel especially prescient with today's news: https://www.sec.gov/news/press-release/2023-223

This is brilliant. Thank you.