Unusual Conclusions with Unusual Whales and Glenn Greenwald

There might be no there there when it comes to congressional insider trading.

There is an anonymous account on Twitter called Unusual Whales (UW). It’s associated with an options analytics website by the same name.

UW mostly posts about option trades and general market commentary. But what caught my attention is what I suspect did for many of its 745,000 followers, which is analysis of the personal trading activities among American politicians. UW’s website has a page dedicated to articles on the topic, which leverages a proprietary database built on information gleaned from mandatory filings.

Presumably, the intent of such work is to bring transparency and accountability to those who hold public office. This has a nice populist undertone to it and foots well with a 2020 yearend tweet where UW stated his purpose as being “…to help the smaller, retail trader against the world.”

I’m personally of the view that UW is providing a great service by tracking congressional trading practices. I have a deep suspicion of politicians and would not be surprised to learn that some trade on privileged information.

I therefore believe that personal trading among politicians should be subject to similar oversight seen in the asset management industry. This would involve either an outright ban on such trading (limiting equity exposure to mutual funds and ETFs) or compliance protocols like restricted lists and/or pre-clearance of all trades.

However, when it comes to commentary involving the issue of trading among politicians, I find evidence of abuse to be lacking. What I see instead is a lot of unjustified provocation that leverages popular mistrust and discontent for clicks.

My wheels originally got turning on this topic a year ago when I read a Substack piece published by Glenn Greenwald. It was entitled “Nancy and Paul Pelosi Making Millions in Stock Trades in Companies She Actively Regulates”.

This sounded compelling given my general distrust of politicians. But I was left unconvinced by Mr. Greenwald’s interpretation of things.

The trouble started for me with the opening paragraph:

House Speaker Nancy Pelosi (D-CA) is the sixth-richest member of Congress, according to the most recent financial disclosure statements filed in 2019. As the California Democrat has risen through party ranks and obtained more and more political power, her personal wealth has risen right along with it. Pelosi “has seen her wealth increase to nearly $115 million from $41 million in 2004,” reports the transparency non-profit group Open Secrets.

The insinuation here (and elsewhere) is that Speaker Pelosi has parlayed her power and influence into outsized trading gains. Absent a full accounting of her trades, we’re left to make summary observations from which we can extrapolate conclusions. In this case, simple math suggests the growth in her wealth was unspectacular. In fact, it was well within expectations given the market backdrop.

(Aside #1: There seems to be some confusion around the Pelosis’ total net worth. Most reporting that I’ve seen puts it in the neighborhood of $115 million. I’ve seen other articles suggest the number could be upwards of $300 million, including some of UW’s own work. To keep things simple, we’ll just run with the $115 million estimate.)

(Aside #2: It’s understood that Speaker Pelosi’s investments are managed by her husband, Paul Pelosi. Mr. Pelosi is a successful businessman and investor whose career exploits serve as the primary source of the family’s wealth. For the sake of simplicity, we’ll refer to Speaker Pelosi’s portfolio as the Pelosi Portfolio or PP.)

For the relevant period 2004-2019, the S&P 500 Index (SPX) generated an annualized rate of return (ROR) of approximately 7% (note: all performance statistics are per Koyfin). The Nasdaq Composite (NDX) generated an annualized ROR of about 10%.

This compares to an implied annualized ROR for PP of 7%. Given that PP’s private holdings (real estate, partnership interests) likely outperformed its liquid ones, we can infer that its equity trades either underperformed or matched the market during this period (depending upon cash and bond allocations along the way).

Far from being sensational, anyone applying a basic sense of compounding to those numbers should emerge unmoved.

Mr. Greenwald spent the rest of his piece highlighting the fact that the Pelosis have been especially active in trading technology stocks. This is problematic to him because Speaker Pelosi “exercises enormous and direct influence” over the tech industry. Of particular concern is that Mr. Pelosi is trading these stocks while “major legislation is pending before the House, controlled by the Committees [Speaker] Pelosi oversees, which could radically reshape the industry…”.

I believe the legislation he is referring to is the Ending Platform Monopolies Act (H.R. 3825), which seeks to limit the reach of powerful tech companies. Included among the firms potentially impacted is Apple, which Mr. Greenwald notes is the most heavily-traded stock in the Pelosi Portfolio. He wrote with dismay about Apple CEO Tim Cook placing a personal call to Speaker Pelosi to lobby against the bill.

But this is not an unusual act on the part of Mr. Cook. CEOs in fact lobby congressional leaders all the time. And given her district’s proximity to Silicon Valley, it makes sense that Speaker Pelosi might join with other California representatives to weigh legislation that might impact one of her state’s most important industries.

Despite whatever protestations Speaker Pelosi may have made, the bill nonetheless advanced through the Judiciary Committee. It’s possible that she may be helping slow its progress through the political process. But this could be the result of good-faith negotiations. And she certainly isn’t alone in pursuing what might be in the best interests of her constituents (if she’s against) or the average consumer (if she’s for).

The point being that Speaker Pelosi has strong political motivations when it comes to technology legislation that may supersede any financial incentives that might exist. Evidence of this is that she recently endorsed bipartisan efforts to rewrite antitrust laws that take direct aim at those technology stalwarts populating her portfolio.

Besides, the Pelosis have been trading tech stocks for years, very often in the absence of any material pending legislation. There is in fact nothing abnormal about PP’s focus on these stocks. Instead, it’s entirely logical given the market’s own focus.

It is well known that the FAANGs (Facebook, Apple, Amazon, Netflix and Google) have propelled equity markets over the past several years. These are some of the most liquid and closely followed companies in the market. With a $2.7 trillion market capitalization, Apple is the largest company in the world and routinely ranks among the most heavily traded stocks on any given day and, indeed, year. So the Pelosis’ focus on these stocks is completely rational given broader market dynamics.

Mr. Greenwald then shifted his attention more specifically to Google:

Beyond that, Google — one of the companies in which the Pelosis’ stock trades have made millions — is one of the top five donors to the House Speaker. The wealthy couple buys and sells in Google stock, making millions. She works on bills that directly affect the future trajectory of Google. And they lavish her campaign coffers with cash, a key source of her entrenched power.

The page Mr. Greenwald links to no longer shows Google as a top five donor to Speaker Pelosi since it has been updated to reflect 2022 contributions (Google now ranks #9). The company’s combined donations to Speaker Pelosi now rank #67 among its list of political contributions for the 2022 election cycle. And at $14,459 of combined individual and company contributions, I’m not sure this qualifies as “lavish[ing] her campaign coffers with cash”, particularly when juxtaposed against the nearly $34 million she has raised thus far.

Google did rank #3 for Speaker Pelosi in the 2020 cycle, but at a grand total of $66,000 out of $39 million, it’s hard to imagine much sway resulting from the company’s contributions.

Even expanding the donation net to include the Nancy Pelosi Victory Fund (a joint fund that primarily benefits the Democratic Congressional Campaign Committee), Google/Alphabet doesn’t show up anywhere among the fund’s top donors. In fact, there is no mention of the company going back to 2012.

I could be missing something here, so I did additional searches on the topic. Several pieces have been written about Silicon Valley businesses and executives contributing to political campaigns. But I didn’t come across a single one that mentioned Google/Alphabet and Speaker Pelosi.

Also, pedantic as it may be, nobody buys and sells in a stock. This is odd verbiage evidentiary of journalistic tourism. People just buy and sell stocks, period. And Mr. Greenwald makes it sound like the Pelosis routinely trade Google stock when in reality there were only two such transactions reported over the reference period.

Similar to the Gell-Mann amnesia I often encounter whenever Matt Taibbi comments on finance or asset management, Mr. Greenwald provided a taste of his own for me.

Multiple times over the last several years, serious questions have been raised about stock positions taken by the Pelosis that turned out to be immensely profitable under suspicious circumstances. Perhaps the most disturbing was a report from Bloomberg News last Wednesday and another from days earlier by Fox Business that documented how Pelosi's husband purchased highly risky options in Google, Apple and other tech companies back in February, 2020, right before the market began plunging due to the COVID epidemic and right before the House, led by his wife, was set to introduce new legislation to regulate those same tech companies.

What Mr. Greenwald is referencing here is the purchase of call options by the Pelosis. There is nothing particularly risky about buying calls. In fact, doing so is among the least risky ways to play options. One of the benefits of buying calls (or puts) is that one’s downside is capped to the amount of premium spent. It’s the writing (or selling) of options (particularly naked ones) that could be considered highly risky.

And the Pelosis tend to buy calls that are in-the-money (ITM), which is among the more conservative ways to play options. This is because there is a higher likelihood that these options finish ITM at expiration (a luxury afforded by higher premiums).

Also important to note about the Pelosi options strategy is the preponderance of LEAPS (Long-term Equity Appreciation Securities) transactions. These are options that are typically at least one year in duration. LEAPS are intended to give investors exposure to prolonged price movements and are thusly poorly-designed for event-driven situations where near-term clarity is typically required (e.g., trading on product development, earnings, legislation, etc.).

There’s also nothing remotely suspicious about these purchases, with Mr. Greenwald really stepping in it when he added emphasis to that final part.

Firstly, the Pelosis only purchased options in two tech companies - Google (GOOG) and Microsoft (MSFT) - in February 2020. Per the Fox Business article he linked to, Apple (AAPL) and Amazon (AMZN) calls were purchased in December 2020 and May 2021.

When someone purchases a call option, they are betting on prices to rally, not fall. Inside knowledge of an emerging global pandemic and impending regulation would not typically bode well for one’s thesis on call buying unless prices were already reflecting all the bad news. But GOOG and MSFT were only down 3.5% and 1.5%, respectively, on the year up to the point of PP’s purchase of those options. I’m not sure how the options were priced but the Pelosis likely would’ve achieved an even better outcome had they waited a month for those stocks to fall another 15-20% to their COVID lows. The point being that it is better to time call buys after a market rout, not just prior to one.

Mr. Greenwald included a Bloomberg headline about the Pelosis locking in $5.3 million from Alphabet options, noting that they were able to net over $5 million from the transaction. But the Pelosis didn’t “net” themselves $5.3 million in that GOOG trade. Indeed, they exercised options that gave them the ability to spend $4.8 million for about $10.2 million in exposure. However, this does not take into account the total premium paid on the position. Per the Pelosis’ filing on the initial buy, we can safely assume the net gain was south of $5 million. Still a great trade, no doubt. But details.

It’s also important to note that the calls were expiring, so Mr. Pelosi had to exercise them. And they were purchased a full 15 months before he locked in his gains.

Mr. Greenwald then linked to two of the “most disturbing incidents” involving MSFT and Tesla (TSLA).

Paul Pelosi in March exercised $1.95 million worth of Microsoft call options less than two weeks before the tech stalwart secured a $22 billion contract to supply U.S. Army combat troops with augmented reality headsets.

In January, he purchased up to $1 million of Tesla calls before the Biden administration delivered its plans to provide incentives to promote the shift away from traditional automobiles and toward electric vehicles.

Mr. Pelosi’s purchase of MSFT stock was the result of call options being exercised near expiration. Those calls were purchased over one year prior. One would have to be remarkably prescient to nail the timing of notoriously slow military procurement with such precision.

The article notes how MSFT rallied 11% in the two weeks following the announcement of that Army contract, which is an arbitrary timeline. If the author had waited two weeks - or even a month - MSFT would’ve only been up about 5% (in line with the broader market).

MSFT is now 25% off its highs. Importantly, the Pelosis have yet to sell any of their MSFT stock. One would think they’d be a bit more opportunistic in taking profits if their trade had been deliberately (and brilliantly) timed in the manner suggested.

Regarding Mr. Pelosi’s purchase of those TSLA calls, the article noted that Speaker Pelosi “likely has insights into Biden’s plans for the [electric car] industry”. Funnily, that comment was immediately followed by “…which are expected to include tax credits and other incentives to promote the shift away from traditional automobiles.” Amazingly, the article’s conspiracy theorizing was established then discredited in the same sentence. Quite the editorial accomplishment, I must say.

In fact, everyone knew that a Biden presidency would be accommodative to the electric car industry. That was part of his climate plan, which clearly discussed “accelerating the deployment of electric vehicles” by building charging stations and restoring tax incentives. President Biden published that plan on June 4, 2019. Mr. Pelosi purchased his TSLA calls a full 18 months later, just as Biden was set to assume office. A Biden presidency being friendly to the electric car industry has got to be one of the least surprising developments in the history of capital markets.

There is nothing “disturbing” about any of this.

Mr. Greenwald’s piece ended with a judgmental flourish:

One would think that one of the richest people in America would be satisfied with that level of wealth — more than anyone could spend in a lifetime — and would decide that she and her husband simply refrain from trading stocks and trying to get richer while she occupies one of the most powerful political positions in the country.

Making value judgments about what constitutes a sufficient level of wealth is very socialist of Mr. Greenwald. I suppose this is a good reminder of his liberal roots, which is helpful given all the dumping he does on Democrats these days and the alliance he’s struck with Fox News and Tucker Carlson.

This comment speaks to the larger issue that I think he and others have with Speaker Pelosi. It’s not so much that she cheats; it’s that she’s fabulously rich. Extraordinary wealth is her ultimate sin and what surely drives much the vitriol directed her way, even on the basis of the most superficial of claims.

By the way, forget about spending Speaker Pelosi’s money in a lifetime: I can think of at least one way to spend her entire net worth in one fail swoop!

Now back to UW.

What caught my attention was a tweet regarding the recent passage of the Chips and Science Act (CHIPS), in which UW summarized congressional returns on semiconductor stock purchases while noting “huge gains” and “unusual trades”.

This garnered over 5,000 likes and elicited a chorus of boos among UW’s followers:

Traders of our generation.

It’s insane this is somehow legal.

This is inside trading and corruption.

Insanely criminal.

This is so crazy.

Let’s investigate.

Tweets are naturally short on detail. Thankfully this one linked to a UW blog post on the topic, which stated the following:

After numerous iterations and lengthy debates, the Senate passed the Chips and Science Act (aka CHIPS Plus) on July 27, 2022. The House quickly followed by passing the bill on July 28. The CHIPS Plus Act provides up to $280 billion in subsidies and funding to the semiconductor industry. The hope is to bolster domestic manufacturing, offer incentives, and increase innovation and R&D in order to compete with global powerhouses like China.

Couple of things here. First, China is not a semiconductor powerhouse. The country is investing heavily in its capabilities - which may have partly informed passage of this act - but it remains far behind the US and others when it comes to most parts of the semiconductor supply chain. This is especially true for the largest value-added segments (per Anysilicon.com).

Second, that performance chart means nothing on a standalone basis. Beyond investigating individual trades for signs of suspicious activity, pulling buy/sell transactions over a constrained period is wholly inadequate on two levels:

We have no idea what constitutes the rest of a subject’s portfolio, how it performed and how the semiconductor piece fits within it; and

The performance of the broader market serves as important context when looking at summary returns. Some of those gains may look big in absolute terms when in actuality they are unremarkable in relative terms (on balance).

Which brings me to my next point. There are 435 members of the House of Representatives. Only 35 of them traded semiconductor stocks. And only seven of the 50-member Senate did the same.

Since UW doesn’t specify dates in his charts (likely because they’re so disparate), let’s assume for simplicity that the numbers capture the period January 1, 2020 through the date of UW’s publication on July 27, 2022. (I appreciate that much of this is an inexact science given the nature of these filings, which UW acknowledges himself.)

During this period, the largest semiconductor ETF - the $7.5 billion Van Eck Semiconductor ETF (SMH) - gained approximately 63%. This compares to an average gain of 30% for those House traders and 24% for Senate traders, making the average congressional return 29%. The median return is even lower at 23% given the skewness of the distribution (i.e., returns are unlimited to the upside but limited on the downside; and we tend to cut our losers faster than our winners).

This also compares to gains of 34% and 24% for the NDX and SPX, respectively.

Of the 42 Congressional traders active in semiconductor stocks, only seven of them outperformed SMH. So less than 10% of Congress traded semiconductor stocks and only 16% of them managed to outperform their benchmark. And only 40% managed to outperform the broader market (as measured by NDX).

Even those who outperformed might be explained by timely profit-taking. SMH was up 122% at its peak over the referenced time period. Stands to reason some folks might look to harvest gains along the way there.

What we should really focus on is the small handful of outlier returns. In the case of the top two performers - Messrs. Wyden and Beyer - not a single semiconductor trade was executed between them over the observation period. Their returns instead apply to positions that were taken well in advance of relevant legislation.

These results suggest that either:

Little trading on privileged information actually occurred since insider trading tends to be of the excessively profitable sort; or

Congress is just like the rest of us: bad at trading.

But that hasn’t stopped UW from suggesting that something’s afoot. And like Mr. Greenwald, he seems particularly concerned with Speaker Pelosi’s investment activities.

By far, Speaker Nancy Pelosi (via her husband) disclosed picking up the most semiconductor stocks since 2020 with approximately $1.5M in Apple (AAPL) and at one point owning about $4.5M in Nvidia stocks (NVDA).

Far from “picking up the most semiconductor stocks”, the Pelosis were active in trading only one of them (compared to seven for Marjorie Taylor-Greene). That’s because Apple is not a semiconductor stock. It’s a consumer electronics company. Yes, Apple designs some of its own semiconductors but that’s not a revenue center for the company. And none of the main semiconductor ETFs include Apple among its holdings.

UW appears more focused on the absolute dollar amount of the Pelosis’ investment in NVDA. But it’s a reasonably-sized position in the context of a $115 million portfolio.

Precisely zero evidence of suspicious activity was provided in UW’s blog post. That’s because there isn’t much to report beyond the circumstantial fact that PP invested in NVDA while semiconductor legislation was making its way through Congress. But PP in effect gained its NVDA exposure nearly a year after CHIPS was introduced in the House and a year before the bill was eventually passed.

Look, it’s entirely possible Mr. Pelosi took his position in NVDA because he developed special confidence that CHIPS would eventually pass and be bullish for the stock. But here again, there is no evidence in UW’s tweets or posts that he was privy to inside information when forming his thesis.

It’s also entirely possible that NVDA was simply a bad trade. Indeed, the Pelosis sold their entire position in NVDA on July 26, 2022 at a reported loss of $341,365. Of course, being a bad trade doesn’t mean rules weren’t broken somewhere along the way. But there is no reason to make such an assumption based on the limited information UW provides in his posts.

This begs the larger question of to what degree legislation actually impacts the stocks of associated industries. NVDA is a good case in point. As an American semiconductor company, one would assume that the momentum and eventual passage of CHIPS would be bullish for the stock. Instead, NVDA has been a dog in 2022. The stock was down 50% on the year through August, which compared to 25% and 32% declines for the NDX and SMH, respectively. Even on the day Biden signed the bill, August 9th, the stock declined 4% as fallout continued from an earnings warning. Seems fundamentals trumped legislation in this instance.

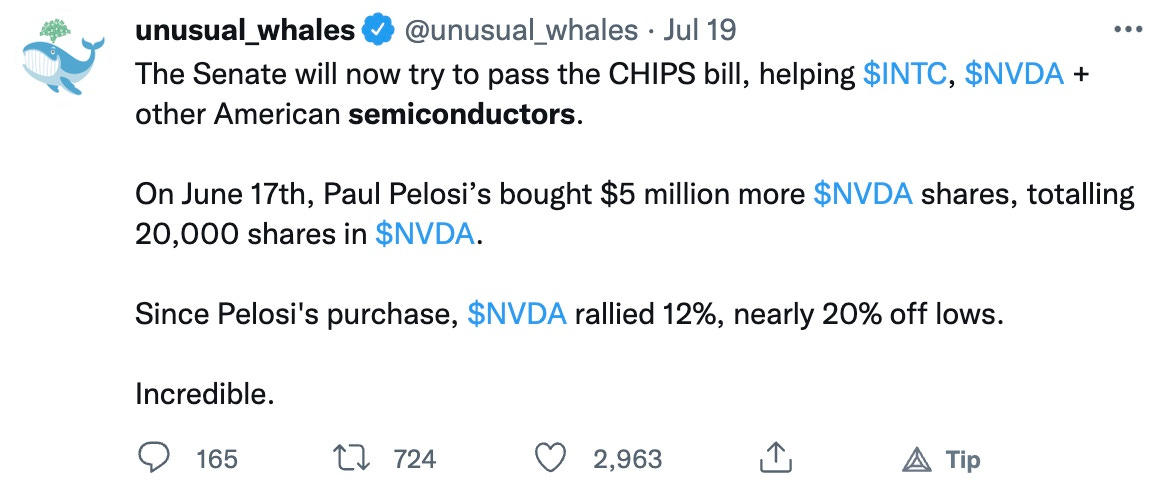

Now back to UW’s conspiracy theorizing.

What’s incredible about this tweet is how misleading it is.

As discussed, PP’s purchase of those NVDA shares was the result of calls that were purchased almost a full year prior. Those calls expired on June 17th, hence the need to exercise them. Exercising a call option involves purchasing shares at a contractually agreed strike price. In this case, the strike price for Mr. Pelosi’s NVDA calls was $100. So in fact, Mr. Pelosi purchased 20,000 NVDA shares on June 17 for $2 million, not $5 million.

Here UW would appear to have either been lazy or deceptive in his presentation of the dollars at play. Disclosure forms usually provide a range of the investment amounts involved in each transaction. PP’s NVDA purchase was listed in the $1,000,000 - $5,000,000 range. But details of the trade were also provided in his disclosure (i.e., Mr. Pelosi exercised 200 NVDA calls at a strike price of $100). UW seems to have just gone with the upper band of the provided range in the disclosure. Intentional or not, this is poor journalism.

Mark-to-market, this appeared a profitable trade since NVDA shares closed at $158.80 that day, which means Mr. Pelosi paid $2,000,000 for $3,176,000 worth of exposure. The trade was unprofitable in the end once costs were accounted for.

Second, NVDA did not rally 12% between the time of PP’s purchase and UW’s tweet. It gained about 7% (from June 16 close through July 19 close), which was a period when markets were rallying in general with respective gains of 8% and 7% for the NDX and SPX.

Moreover, the end date chosen by UW is arbitrary. Had UW published his tweet on July 1st instead of July 19th, NVDA would’ve been down nearly 9% since the exercise of PP’s options (versus a gain of 3-4% for SPX and NDX). Had he sent his tweet on July 15th, NVDA would’ve been down about 1% (versus gains of 5-6% for the SPX and NDX).

UW published other tweets that insinuated nefarious NVDA activity.

The Pelosis owned 25,000 shares of NVDA at that point, not 20,000. And CHIPS breezed through the House with voting predictably broken down along partisan lines. The bill was sponsored by the Democrats, so it’s not like the market was waiting with bated breath to see which way Speaker Pelosi would fall on the issue. Removing the mystery of Speaker Pelosi’s support - and that of the House for that matter - also removes the potential for any secret insight to be shared.

While NVDA played a key role in UW’s Pelosi semiconductor assertions, he later implied potential for conflict involving PP’s AllianceBernstein (AB) investment in a separate tweet.

This again strains credulity. AB has $650 billion in assets under management (AUM). Suggesting that Speaker Pelosi would use her office to affect the outcome of a stock that represents 0.02% of AB’s AUM is quite the stretch. And UW’s use of the word “heavily” is doing a lot of work here. $3.5 million is big money to most people. But for a portfolio on the order of $115 million, it’s a rather pedestrian 3% position. TSM could quintuple from here and still be a rounding error for AB.

The reality is that Taiwan Semiconductor is a critical asset that sits at the heart of an emerging geopolitical conflict between China and the United States. To not visit the company on the Speaker’s trip to Taiwan would’ve been a dereliction of duty.

But that doesn’t stop UW from tweeting about it and letting the imagination of his followers run wild.

Disappointed with the case made by UW in his semiconductor post, I moved on to others that focused on Speaker Pelosi (assuming she’d make for the easiest lightning rod). There are other pieces that I hope to get to eventually. I just can’t boil the ocean all at once here.

One post simply pointed out how the Pelosis had a good year of trading. As far as I know, this is not a crime. The only specific mention of “unusual” trades was the below:

Most of Pelosi's gains are quite interesting, given the timing of her plays. For example, she was able to get into TSLA, DIS around stimulus news, NVDA before American Semiconductor funding was announced, among a long list of interesting picks. Mr. Whale leaves it to the reader to check her transactions and the news around her purchases (all available for free on the platform). She also timed the NFLX buys on June 18th perfectly. It was released on July 14th that NFLX is entering the videogame space, causing the stock to rally significantly.

This also falls apart when subjected to light interrogation. Since we’ve already addressed NVDA, let’s look at the others.

The Pelosis purchased Tesla (TSLA) and Disney (DIS) calls on December 22, 2020, both of which were longer dated with expiry 13-15 months out. Importantly, these calls were purchased one day after a $900 billion COVID relief package was passed by Congress.

So sure, UW is technically correct that the Pelosis managed to “get into” TSLA and DIS “around stimulus news”. But their trades were executed after the news, not before. That seems a pertinent detail when it comes to suggestion of front-running.

Even so, passage of that bill was long anticipated as it won a huge majority in both the House and Senate. The bill’s imminent passage had surely been priced in, as evidenced by the market’s collective yawn at the news (with the SPX down small each of the three trading days surrounding it).

Even by his own math, the Pelosis were basically flat between the two trades as of the date of his blog post. Through today, I reckon they’re meaningfully underwater on both. Not particularly “interesting” trades to highlight if you want to build an insider trading case.

With regard to PP’s Netflix (NFLX) buys being “timed” perfectly, UW couldn’t be more incorrect in his framing. PP’s NFLX buys were initiated almost two years in advance of its video games announcement.

On July 5, 2019, the Pelosis purchased 20 NFLX call options with a strike price of $250 (when the stock was trading at $380 so ITM) and expiration on June 19, 2020. Those calls were exercised on June 18, 2020 when the stock was trading around $450.

It was reported that NFLX intended to enter the video game market over one year later on July 14, 2021. From the date of exercise through announcement, NFLX gained 21% compared to 47% for the NDX.

The stock actually declined 9% in the week following its video game announcement versus a 1% loss for the NDX. The stock fell 7% through month-end July versus a 2% gain for the NDX. It gained 1% through month-end August versus a 12% gain in NDX. It fell 4% through month-end September versus a 6% gain in the NDX.

As of this writing, the Pelosis have held on to their NFLX position, which too is underwater with the stock price now down ~50% (to $223) since their calls were exercised.

Nothing about PP’s NFLX trade should strike anyone as perfectly timed.

UW wrote another post that took a deeper look at the Pelosi Portfolio, providing cursory analysis of the family’s investments and income sources. In doing so, he confirmed something important for me: His primary complaint is that Speaker Pelosi is rich, not necessarily that she cheats.

He did this early in his post when the first bullet point in his TLDR summary was that Speaker Pelosi is “RICH, RICH”. He then flippantly noted that he wished he “could sell grapes for $1 million too”, made in reference to a vineyard owned by the Pelosis. Managing a winery is a difficult business that is minimized by reducing it to just “selling grapes”. He betrayed a deep jealousy with this comment that I suspect informs a lot of his work. I suppose I wish I could make UW money by “punching buttons on a keyboard”.

Further down the post, UW notes that Speaker Pelosi has been in office since 1987 and only makes $223,500 per year, followed by a breakdown of her income that measures in the millions. The dichotomy he is going for here is obvious. How could she become so rich on that salary? Left out of course is the critical fact that Mr. Pelosi is himself a successful businessman and the source of much of the family’s wealth.

The rest of the piece summarizes PP’s trades over the last several years. I must admit I had a tough time following everything, but the gist seems to be that the Pelosis have been profitable on balance. The key to their success per UW? Buy tech stocks or deep ITM LEAPS, hold on to the position, see that the economy runs smoothly, and profit.

So basically buy and hold while ensuring the country and economy remain strong. Sounds sketchy to me!

The foregoing has fueled a belief that Congress is suspiciously full of incredible traders who manage to consistently beat the market. Basic analysis of the facts - as presented by UW and Mr. Greenwald - suggests nothing of the sort.

But social media is built on bias-confirming hot takes rather than open-minded consideration of nuance. The popular narrative of insider trading among politicians therefore persists, even among those I’d like to think should know better.

A good example is the following clip, in which Krystal Ball and Saagar Enjeti of Breaking Points highlight their friend Mr. Greenwald’s piece, which they say conducts a “deep dive” into “specific examples” of corrupt congressional trading practices. Ha!

It just seems like they’re incredible at picking stocks. They always beat the market somehow…just geniuses running the country.

This is a red meat talking point for “anti-establishment” media personalities like Krystal and Saagar, who often take sound bites and run with loose interpretations that fit their own preconceived notions of the world. Naturally, they took the bait with Mr. Greenwald’s piece and echoed his sentiments at every turn, facts be damned.

The clip is a troubling watch for anyone interested in accuracy in reporting. Sadly comical to me is the palpable discomfort with which Saager speaks about these topics. The poor guy is out of his depth, which is painfully obvious to his informed audience.

$5.3 million in options! That’s not a joke. Options have a much higher propensity in order to go to zero. It’s much more akin to a casino level bet than it is just buying and selling a security that may or go up by 5, 10, 15 percent. The payouts are huge and the downside is big…My guess is, somebody worth this type of money, knew something which caused them to put so many millions of dollars on the line.

Saagar’s garbled mess of an explanation is as much a disaster in diction as it is in content. I won’t belabor points already made but suffice to say Saagar hasn’t a clue what he’s talking about. And he too reveals the tension that underlies much of the consternation surrounding Speaker Pelosi: She is rich.

By the way, I’d put Krystal’s ending comment back to her and Saagar: It’s not too much to ask that, given your platform and reach, you conduct at least a modicum of analysis before perpetuating falsities to the general public.

Information presented on social media is often a function of what we want to see, both in terms of our consumption (interpretive bias) as well as its presentation (audience capture).

Folks like UW and Mr. Greenwald - who have 2.5 million Twitter followers between them - are playing to the crowd with their work, capitalizing on the insecurities and gullibility of a fandom where the mere suggestion of congressional impropriety is taken as evidence of such.

All of this handwaving works in an era characterized by institutional and generational betrayal, where confirmation bias allows the myth of congressional insider trading to propagate despite little evidence supporting such accusations.

It’s thusly not so much that we should believe politicians cheat when they trade; it’s more so that we just want to believe it.

Would it surprise me in the slightest to learn that members of Congress regularly abuse their office for personal financial gain? Absolutely not. But it’s going to take more than loosely gathered circumstantial evidence to convince me that any such violation is occurring en masse.

The same should go for all of us.

Shilling for Pelosi is a new low.

u spent all this time and no one's gonna read this