A Special Situation to Research

For Entertainment Purposes Only

A gentleman who goes by the name of Jay Singh runs a bespoke research and investment newsletter service called Special Situations Research (SSR). He can be found on Twitter at the handle @specialsitsnews, where he’s built a following of over 90,000 as one of the more popular financial Twitter (“FinTwit”) accounts. He also runs a Discord and routinely appears on Twitter Spaces and other platforms to wax philosophical on all topics finance and investing.

Jay’s claim to fame is that he once managed over $2 billion for Goldman Sachs. This used to be the gold standard when it came to a portfolio manager’s pedigree in professional investing circles. The path from Goldman PM to newsletter writer is not a well-trodden one, but it looks like Jay is blazing a nice little trail of his own.

SSR’s subscription service is a disjointed, multi-tiered one, with sixteen different options whose prices range from $20 per month to $60,000 per year. The company also offers off-the-shelf valuation models in addition to what sounds like on-demand research services.

I’ve reviewed about a dozen examples of SSR subscriber updates. They include very basic company models, abridged investment theses and what looks like copies of pages from an investment textbook. It’s all quite random and uninspiring, but that must be good enough for the hundreds of clients Jay claims to have.

SSR’s website is janky and surprisingly devoid of information. For example, its custom projects page includes a bunch of arbitrary price quotes and names of people with generically titled assignments. And the photo for each project is the same Excel snapshot of some SPAC directory. Here we learn that we could pay $746.25 for something called a Yonezu Project or $755 for a two-hour Polanksy Project. Or we could pay some dude named Justin $75 for 15 minutes of his time.

There is zero detail provided about any of these projects, so I’m not exactly sure what they’re meant to advertise. But I suppose they must be intriguing enough for some.

Things get funnier. Under the “More” tab, we see two options for “Our Story”. Clicking on the first one tells us nothing about the company’s story. All it does is basically say that its offerings are meant to be educational (which is totally inadequate for CYA purposes in the same way as saying Not Financial Advice is). Clicking on the second “Our Story” presents us with the most misleading “Full Story” headline ever:

This is followed by an 18-second Vimeo that has no sound, no video, no graphics.

Maybe I’m being too hard on the SSR website since a cursory check of its peers doesn’t impress much either. Take GLJ Research, which was founded by Gordon Johnson (@gordonjohnson19) - another one of those outspoken Tesla bears who has been fantastically wrong for years - and whose website makes a better aesthetic impression but still manages to strike some odd poses of its own.

For example, GLJ claims to identify “unique investment opportunities” and “targets relatively unresearched businesses” in its quest for alpha. Yet many of the names in its coverage universe are large and well-covered, including the likes of Rio Tinto, Fortescue, Cleveland Cliffs, and U.S. Steel in addition to Tesla. The home page claims that the company “covers 14 stocks” but it shows reports on 19 different companies as of this writing. Clicking on “Read More” under “Who We Are” takes us to an error page. And we’re told that the management team consists of Gordon and another gentleman named James Bardowski, who is listed as Chief Investment Officer and Managing Director (and whose name is funnily misspelled in the header).

I’ve no idea why an independent research provider would require the services of a CIO, especially from someone who appears to have exactly zero experience managing money professionally. Funnily, Bardowski’s LinkedIn profile describes his GLJ role as more of an analyst and programmer. Even funnier, it appears he left GLJ in July 2022. Yet there he remains as a member of the leadership team on the company’s website.

Back to SSR and its own strange website. The most important feature - for me at least - is the lack of detail about Jay’s background as well as that of his colleagues (vaguely referred to in various forums as a team of analysts). A Combat request for information about the team through the SSR website was rejected, with the company noting that it prefers to avoid online scrutiny and that its work speaks for itself.

Such secrecy strikes me as odd. The edge of any research consultancy is the pedigree of its people, making their collective experience a key part of the marketing collateral. For example, we know exactly who is behind research outfits like Hedgeye. And guys like Jim Bianco and Tommy Thornton pretty much have their names on the door.

Why doesn’t Jay advertise himself and his team in similar fashion?

Let’s back up a bit.

I first came across Jay several months ago while listening to a Twitter Space. He appeared to me a thoughtful guy with a solid grasp of the investing vernacular. But the more I listened to him, the more my curiosity was piqued.

What specifically struck me was his verbosity. The man demonstrated a remarkable tendency to talk a lot without saying anything. He would routinely branch off in random directions when posed with questions, oftentimes never returning to the original point.

Lucky for him, most of us couldn’t help but be impressed despite his meandering. He sounded awfully smart while delivering his soliloquies and it was clear he was speaking from experience.

But something didn’t sit right with me. Where I come from, the most effective investors have excellent signal-to-noise ratios; which is to say, they are good at cutting out the fluff and getting straight to the heart of a matter. The ability to simplify is an edge, especially in the cutthroat world of hedge funds where time is money.

Conversely, Jay was very good at making everything sound hard. I reckon he doth complicate too much, so much so that he must be compensating for something. As the French saying goes, la culture c'est comme la confiture, moins on en a et plus on l'étale. Hearing him speak just felt so overwrought.

I also began to detect an arrogance with Jay that seemed tinged with an air of grievance. I speculated privately that he was probably a smart but frustrated analyst at a larger shop and that his Twitter persona could be a way for him to seek the adulation that may have eluded him in his career. Since most FinTwit rooms are largely populated by amateur investors, it can be easy for a pro to sound smarter than everyone else.

I decided to test my hypothesis by engaging Jay on a Space hosted by Joe Fahmy (@jfahmy) back in November. The topic under discussion was an upcoming Fed meeting and participants were speculating about what might come next.

As usual, Jay was treated as the guest of honor, and he delivered for us a long, tortured assessment of all the various paths the Fed might take. The grandiloquence was strong that evening and nowhere in his rambling discourse was there a view expressed as to what Jay expected could play out.

I interjected by suggesting that Jay cut to the chase and tell us what he sees ahead. His reaction was fascinating and did well in confirming my suspicions about him. In the process of dropping several F-bombs, Jay informed me of the following:

that he has more investment knowledge in his pinky than I’ll ever have;

that I have no idea how hedge funds work because CIOs expect the kind of (pointless) analysis he provided just then;

that I must be obsessed with him because I have a small Substack and might be looking to write a book about him or something (even though this was our second interaction ever on Twitter and the first verbal one);

that he has clients who pay him $5,000 for the kind of wisdom he had just shared;

that I piggybacked on his George Noble takes (a pretty rich accusation for fans of this Substack); and

that we’re all lucky he’s talking to us because his girlfriend had come over and he should be spending time with her.

I was removed from that Space despite being subjected to multiple insults and never hurling one in return myself. God forbid the great Jay Singh be challenged by anyone.

(Editor’s note: Jay would go on to tweet another couple dozen times that evening, leaving said girlfriend thrilled I reckon.)

I admittedly came in hot to that discussion and suspect Jay is quite right to assume he knows much more than I do about investing. But something I know about the real ones is they don’t respond to challenges with insults and peacocking. That’s because they are secure in their status and feel no need to project. What we got from Jay was instead the exact opposite, which was evidence to me of a deep insecurity underpinning his online persona.

I made a mental note to return to Jay someday and moved on to other things.

Jay resurfaced for me while listening to one of those marathon Mario Spaces that jumps from crisis to crisis. This one dealt with the recent banking drama and featured the usual clown car of absurdity sprinkled with the occasional voice of reason. Jay was a regular participant in those sessions and I found his contributions reassuring. He brought a sense of realism and expertise that was sorely lacking otherwise.

I was growing content to just leave him be despite my incredulity. But then I came across a series of tweets from the great GuruLeaks that got my wheels turning again.

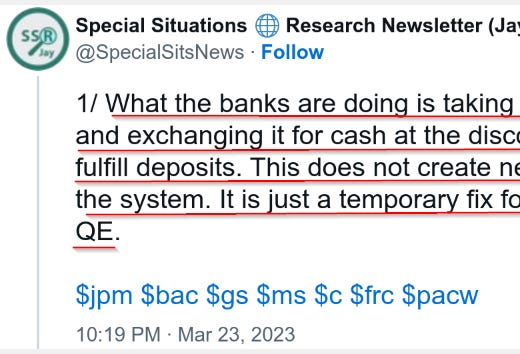

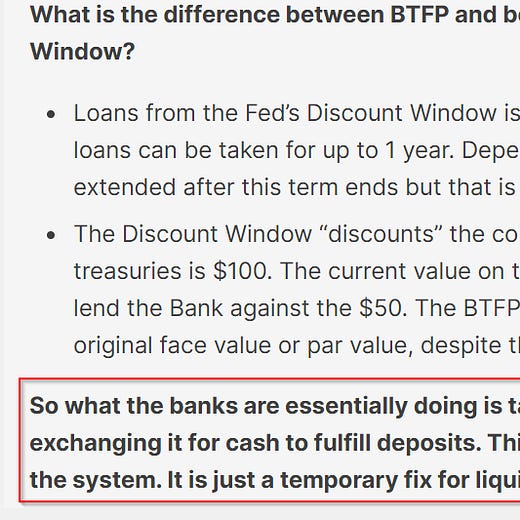

In those tweets, Guru shared multiple instances of Jay copying sentences - word for word - from the work of financial blogger Ayesha Tariq.

As is often the case, the coverup looked even worse than the crime, with Jay effectively admitting that he routinely copies what people send him. His reasoning apparently being that he’s smart enough to figure this stuff out anyway so why not just save some time and quote others without attribution.

It turns out this wasn’t Jay’s first run-in with accusations of plagiarism, as another FinTwit account caught him lifting a meme of theirs a month or so earlier:

(Editor’s note: It appears that the above tweet was deleted, hence the lack of images. The original version suggested that Jay copied a meme produced by someone else and passed it off as his own.)

This all got me thinking. If Jay can behave this shamelessly in full view of Twitter, what might that mean for the work he conducts beyond the public eye?

I then decided to conduct a deeper dive into the man himself.

But first, a quick note on anonymity. In short, I’m a fan of it. As an anon myself, I should be. I believe it facilitates a freer flow of ideas than complete transparency would otherwise allow.

In my way of thinking, there are several good reasons why folks desire anonymity on Twitter. They may be speaking truth to power in a politically or professionally sensitive context. They may enjoy cracking jokes, engaging in debate, testing ideas or just shooting the breeze but worry their offline lives may interfere with that exploration. They may be high profile individuals who just like to putz around for shits and giggles without causing a stir. Or they may simply enjoy the mystery of it all.

There are also plenty of bad reasons why some users remain anonymous. They could be trolls who desire only to wreak havoc as compensation for their otherwise unfulfilling lives. They could be professionals of a sort who use Twitter as a release for the darker side of their personalities. They could be shills pushing product through spam or some other fake engagement strategy.

Or they could have something to hide.

The original draft of this piece proceeded from here to detail all the sleuthing I did to uncover Jay’s real name. It took a decent amount of work and I’m pretty sure I was able to successfully identify him.1

When I reached out to Jay for comment, noting what I believe to be his real name, he initially responded by saying that the named individual did in fact assist SSR in its early days. When I pressed him to confirm or deny whether he was the individual in question, Jay responded with threats of legal action, specifically referencing slander.

Slander involves knowingly making a false spoken statement about someone that damages their reputation. Libel is the written equivalent of slander, which is what would theoretically apply here.

But I’m pretty sure I know who Jay is. And he knows I know. This would do away with the “knowingly making false statements” part of any accusation of defamation.

Interestingly, Jay momentarily took his Twitter account private after my outreach. And the gentleman I identified as being the real Jay coincidentally abbreviated his name on LinkedIn - perhaps in an attempt to be less conspicuous - and he put an end date of December 2022 for his latest employment stint with an asset management firm based on the East Coast. The plot thickened further when I noticed a few weeks later that the individual in question had re-edited his LinkedIn to show him as remaining employed by the aforementioned firm.

I ultimately decided to keep hidden what I theorize Jay’s identity to be not because of concerns regarding legal action but more so on ethical grounds. As much as I enjoy the discovery process, I feel uncomfortable with the act of publicly doxxing someone. It’s just not my place, even when certain other characters damn near beg for it.

You might be wondering why Jay’s true identity is relevant. Well, there are good reasons why his (theoretical) employer and subscribers might want to know about his extracurricular activities. But the more important objective in my mind is to better understand the chops of our FinTwit heroes, many of whom I believe are betas masquerading as alphas (in an investment sense, of course).

My working hypothesis is that Jay is a full-time analyst who has managed to turn himself into a FinTwit superstar with his SSR side hustle. If he is who I think he is - which I cannot state for certain - Jay appears to be a journeyman who’s held almost as many jobs as he’s spent years working (with an average stint lasting about 1.5 years).

I appreciate that the investment business can be a mercenary one and people move around. But I also know firms usually try hard to keep their top talent. And star fund managers typically end up launching their own funds rather than bouncing from firm-to-firm while failing to show up on the leadership page of their current shop.

To be sure, the person I believe to be Jay has a resume with some impressive names listed. It includes a dalliance with an offshoot of Goldman’s legacy proprietary trading business, formerly known as the Goldman Sachs Principal Strategies Group (GSPS). A number of respected fund managers grew up at GSPS, including some mentioned by Jay in prior interviews. GSPS was technically shuttered on the back of Dodd-Frank, which led to the spinout of a captive hedge fund of sorts.

It is my understanding that this business had somewhere between $5-$7 billion in assets under management during Jay’s purportedly brief tenure at the firm. I find it difficult to believe that the fund’s CIO would cede 20-25% of his book (assuming leverage) to someone with Jay’s experience at the time. And even if he did have discretion over such a meaningful chunk of the portfolio, we’re left to wonder about Jay’s performance given a stay that appears to have lasted less than two years.

I could be wrong, of course. But color me skeptical.

Jay wouldn’t be the first person to leverage the Goldman brand to give the impression of legitimacy. Nor would he be the first to pursue a form of title inflation. A great recent example of this is a kid who parlayed an eight-month stint as a junior analyst in Goldman’s wealth management group into pontifical tweets sharing wisdom he gleaned from “helping” to manage billions of dollars.

I’ve no doubt that Jay contributed to the management of a portfolio of some sort while at Goldman. My question is whether he actually had ownership of that P&L. Or would it be more accurate for Jay to claim that he “helped” manage that money instead?

Look, the individual I’ve identified is clearly an experienced, capable guy. Someone like him doesn’t get hired at the firms he’s been hired at for being a dummy. But he probably doesn’t last long for a reason.

Whether Jay operates within the bounds of his current employer’s policy on Outside Business Activities is between him and his employer (to the extent one in fact exists). And whether he is being fully transparent about any potential for conflict is between him and his subscribers.

But there’s a broader point to be made here that speaks to an aggravation I have with FinTwit. It involves a type of stolen valor that I’ve written about before, where the most popular accounts tend to be those of savvy salespeople rather than successful investors.

The primary determinant of a successful career in the investment management business is the generation of profits, typically through the act of trading and preferably via alpha (or skill). Yet many of FinTwit’s finest either have little-to-no experience managing money or have proven to be demonstrably poor at it.

So instead of providing actionable insights that translate to real world results, their objective is to appear smart ex ante and right ex post, oftentimes in order to gain followers who double as potential clients for one product or another. We are occasionally presented with a shot at accountability through the scoreboard of real world fund results. But more often than not their musings are lost to the dustbin of deleted tweets, poor collective memory or obfuscation.

As the author and scholar Jonathan Gottschall eloquently observed in The Storytelling Animal: How Stories Make Us Human:

Memories are often pruned and shaped by an ego-enhancing bias that blurs the edges of past events, softens culpability, and distorts what really happened.

Thanks to their oratory skills and our psychological affinity for complexity theater, we remain impressed with these individuals despite their track records (or lack thereof). It’s a bit like a teacher receiving praise for their enjoyable lectures but whose academic outcomes disappoint. Or a sports coach who knows the game cold but is incapable of fielding a competitive team.

Imagine seeking advice from someone who has never proven effective at doing the very thing you’re asking about. Seems kinda silly, right? But that can be observed everywhere on FinTwit.

George Noble (@gnoble79) is among the most blatant examples of this phenomenon. He rose to FinTwit fame by holding “the best Spaces with the best guests, the best listeners and the best moderation”. To this day, even in the midst of one of the most remarkable drawdowns ever witnessed, people remain convinced they derive value from his discussions. But if the man himself - with his four decades of experience - can’t take all those amazing insights and action them profitably, why should we expect his listeners to do so?

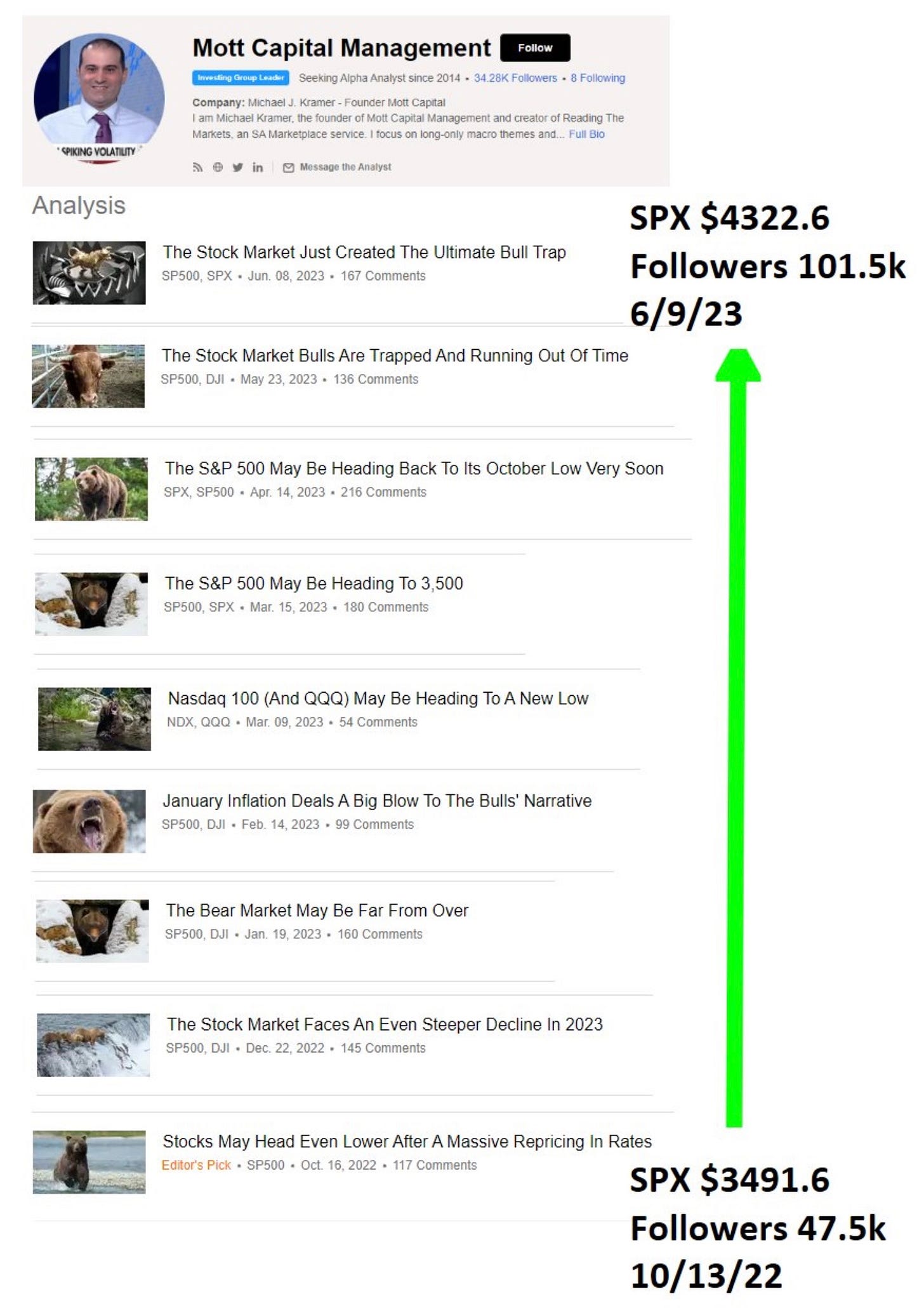

There are plenty of other examples. One that came to a bit of a head over the weekend involves Michael Kramer (@MichaelMOTTCM) of Mott Capital Management. Kramer is an execution trader turned financial journalist turned independent money manager. He writes a Substack called Reading the Markets to go along with his weekly MCM Market Commentary. He’s also active on Twitter, where his musings have attracted a large following and earned him the status of furu (short for FinTwit guru).

Kramer claims 30 years of market experience but I count closer to 20. It appears he includes his years spent as a Financial Writer as market experience, which to me is like Stephen A. Smith counting his time at ESPN as an athletic career.

Resume padding aside, Kramer does have an actual track record to point to, which is saying something when compared to many of his furu peers. His performance can be found over at the Interactive Advisors website, which includes summary statistics as well as a link to his last published investor update from July of last year. That piece includes a performance summary of its own (which runs through Q2 2022):

Using this and the latest statistics from Interactive Advisors, what I see is an investor who has put up respectable absolute numbers but poor relative and risk-adjusted ones. Specifically, Kramer appears to be annualizing at 9.3% net since inception with 20.3% vol and a Sharpe ratio of 0.27. This compares to an 11.3% annualized rate of return and slightly lower vol for the S&P 500. And it doesn’t appear that any diversification benefits are on offer. All of which begs the question of why folks invest with Kramer in the first place.

But mediocre performance hasn’t stopped him from accumulating a large following by pursuing his own form of cowbell. This was illustrated over the weekend when he threatened to quit Twitter after user @ChartingCycles dropped a tweet that included the following graphic:

This little episode gives credence to the notion that accountability is furu kryptonite. Giving the appearance of infallibility and infinite correctness is inherent to the furu business model. When held to account, they scream victim and throw Twitter tantrums. Rarely do they admit fault; that would be bad for business.

(Don’t worry folks: Our guy came right back. Because, you know, marketing.)

Moving on to other examples, Michael Green (@profplum99) of Simplify Asset Management can often be found on Twitter debating macro nuance ad nauseam or holding court on Spaces in the most condescending tone imaginable. To his credit, the man is very intelligent and articulate, which reminds me of another of his professorial brethren, Michael Gayed (@leadlagreport).

But as far as I can tell, there is scant evidence these guys can turn their myriad insights into trading success. Like many of their FinTwit peers, they epitomize for me the notion of theory being quite different from practice. Yet their popularity persists since, as Gottschall has noted, “we are, as a species, addicted to story”.

This all makes me wonder if these guys should change their CYA disclosures from “Not Financial Advice” or “For Educational Purposes Only” to “For Entertainment Purposes Only”. At least then we’d have some truth in advertising.

Which brings us back to Jay, who betrays his own amateurism quite often. Whether it’s offending large allocators on a Mario Space (which no real fund manager would ever do) or claiming to have 40 different bank accounts with $250,000 each for diversified FDIC coverage (which no real HNW individual would ever do), he provides glimpses into his true nature for those of us paying attention.

Yet Jay will maintain his furu status because he sounds so darn smart and most of us are so easily impressed. He’ll continue to grace us with his presence on Spaces and be celebrated for all of his stunning insight. Many listeners will emerge convinced that they’re being made better investors in the process. But it is my contention that the only real value most of us derive is of the entertainment variety.

The information used to form the basis of this article was obtained via Open Source Intelligence. All such information was made publicly available by Mr. Jay Singh himself (the “Subject”) or by his respective affiliate organizations, current and prior, established and purported. Information sources include but are not limited to the Subject’s published tweets, interviews, Spaces discussions, public profiles and affiliated websites.

Reasonable care and diligence was undertaken by Narrative Combat (the “Publisher”) in the formulation of any speculation contained herein. The Publisher reserves the right to make its research available to the public at any time.

None of the information contained herein relating to speculation about the Subject’s true identity should be construed as a statement of fact. Any such speculation is solely the opinion of the Publisher and whose factuality has not been independently verified.

The Publisher contends that the Subject has, for all intents and purposes, voluntarily assumed the position of a limited-subject public figure on the basis of his extensive social media presence and activities, which include, but are not limited to, his contributions to public platforms such as Twitter, LinkedIn, Instagram and Discord.

Given the Subject’s significant social media presence and activities, the Publisher believes that the information contained herein serves to benefit the Subject’s subscribers, social media followers and the broader financial community.

For the avoidance of doubt, this article was published For Entertainment Purposes Only.